in |

LendInAsia is a website and app development company that remodels offline lending businesses by helping them to go digital. After years of relentless hard work, we acquired extensive knowledge in constructing sophisticated web projects for both backend and frontend development, as well as mobile apps for top platforms of all sorts, including Android and iOS.

WHY

CHOOSE US

01

AI for Data Analysis

Provide a metric score and data matching to prevent spammers or hackers.

02

Lending Digitalization

Our intelligent end-to-end solutions automate parts or the entirety of lending process for all realms of businesses.

03

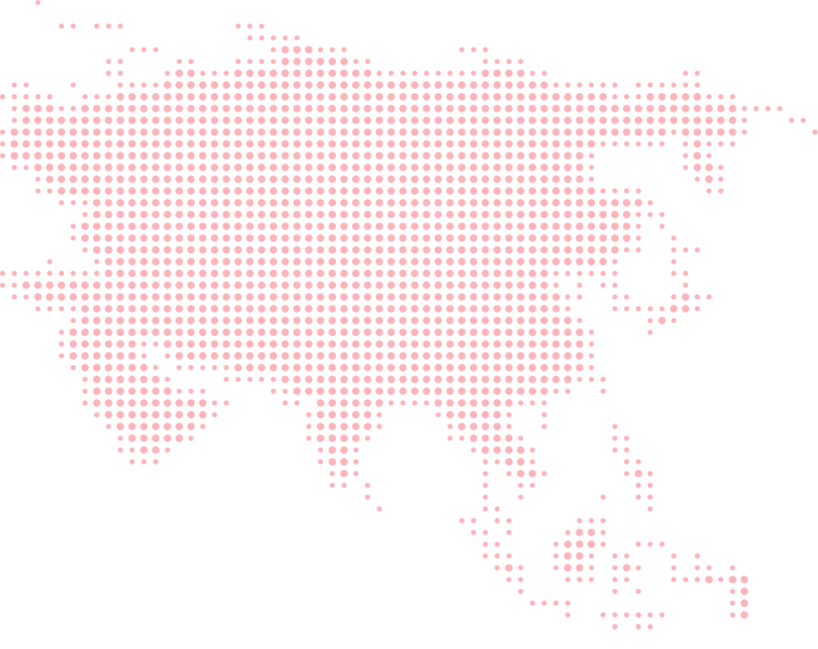

Enterprise-grade Security

From domain protection to proxy server through cloud distribution, we ensure that only your appointed device has access to the admin portal.

04

Training and Support

Our thoroughly trained business analyst team will provide online or onsite trainings so that your team can maximise the full potential of our intelligent lending automation.

05

Implementation Updates

We provide services to support rolling updates and bug fixing even after the project went live.

Outstanding Features

Adjust your lending operation to stay competitive in the digital age.

Centralised

Blacklist Portal

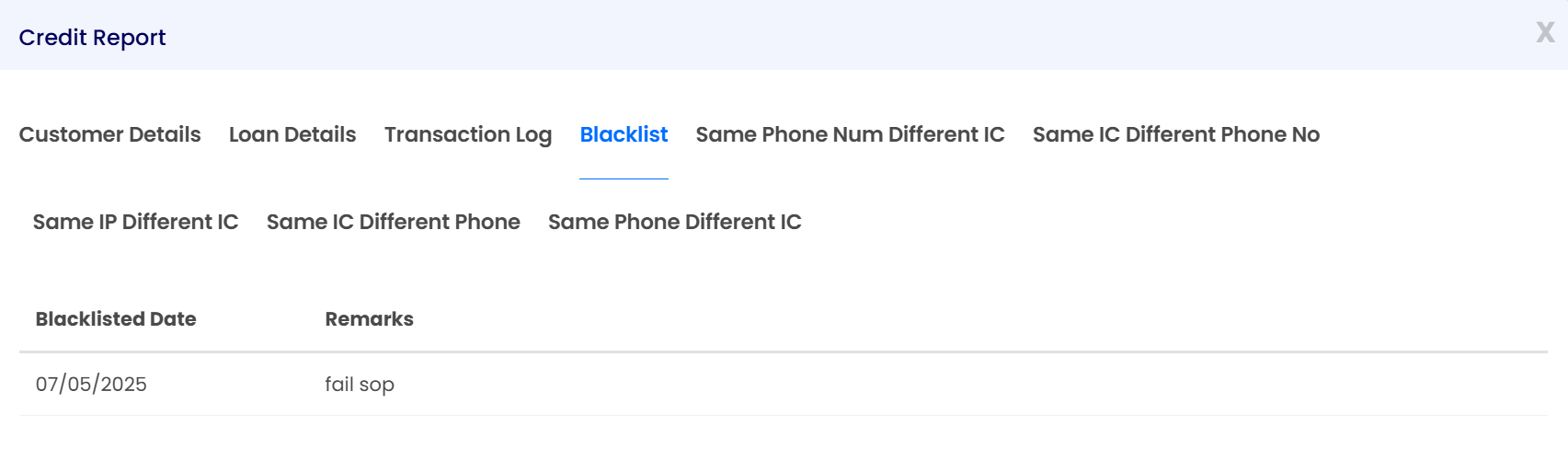

With over 100+ brands using our platform, we compiled a blacklist portal to make sure that you will not meet any bad applicants.

Multilingual Platform

From frontend web pages to backend admin portals, our platform is offered in all languages spoken in Asia, namely EN, CN, BM, ID, TH, VN, etc.

Submission to

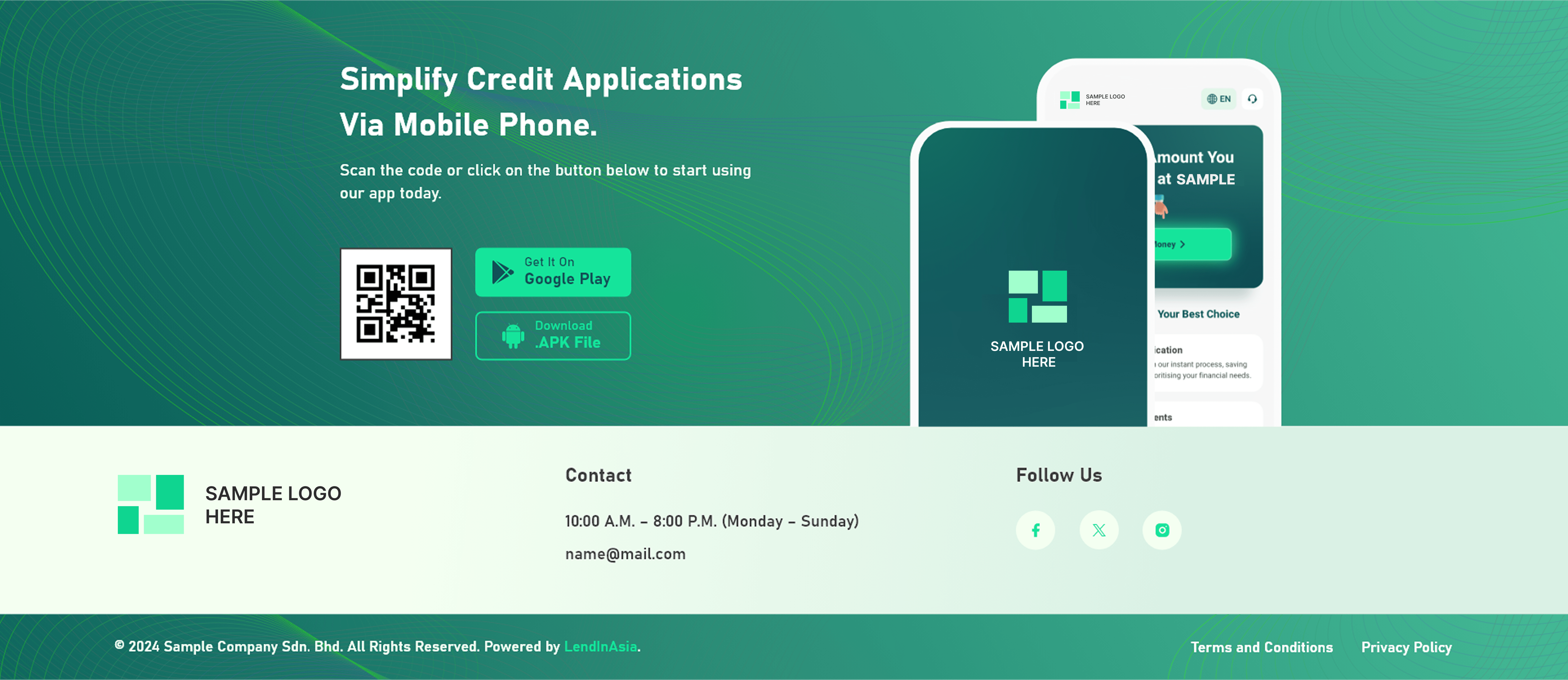

Play Store

Offer guaranteed submission to official Google Play Store in addition to alternative hosted APK and iOS download URLs.

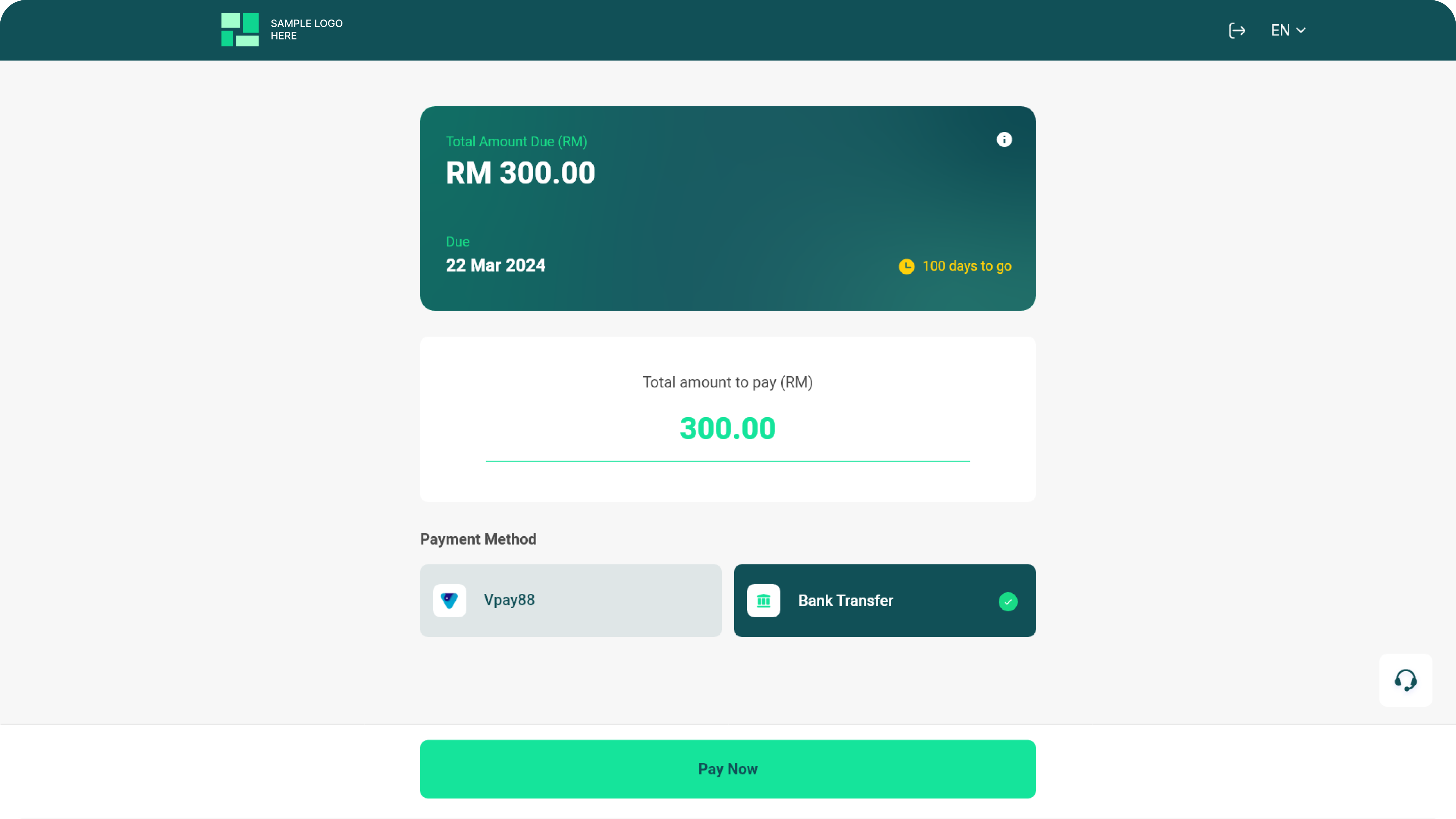

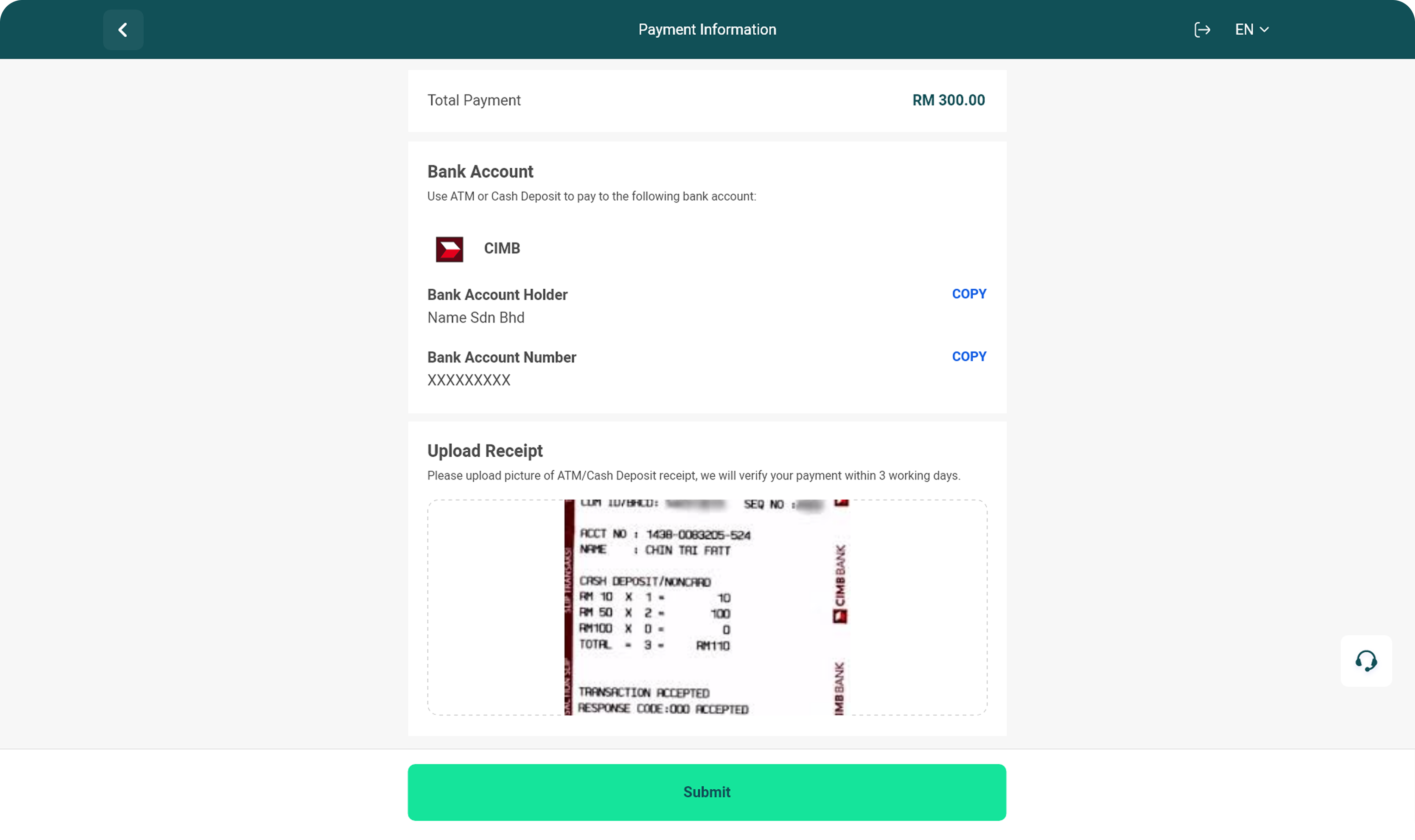

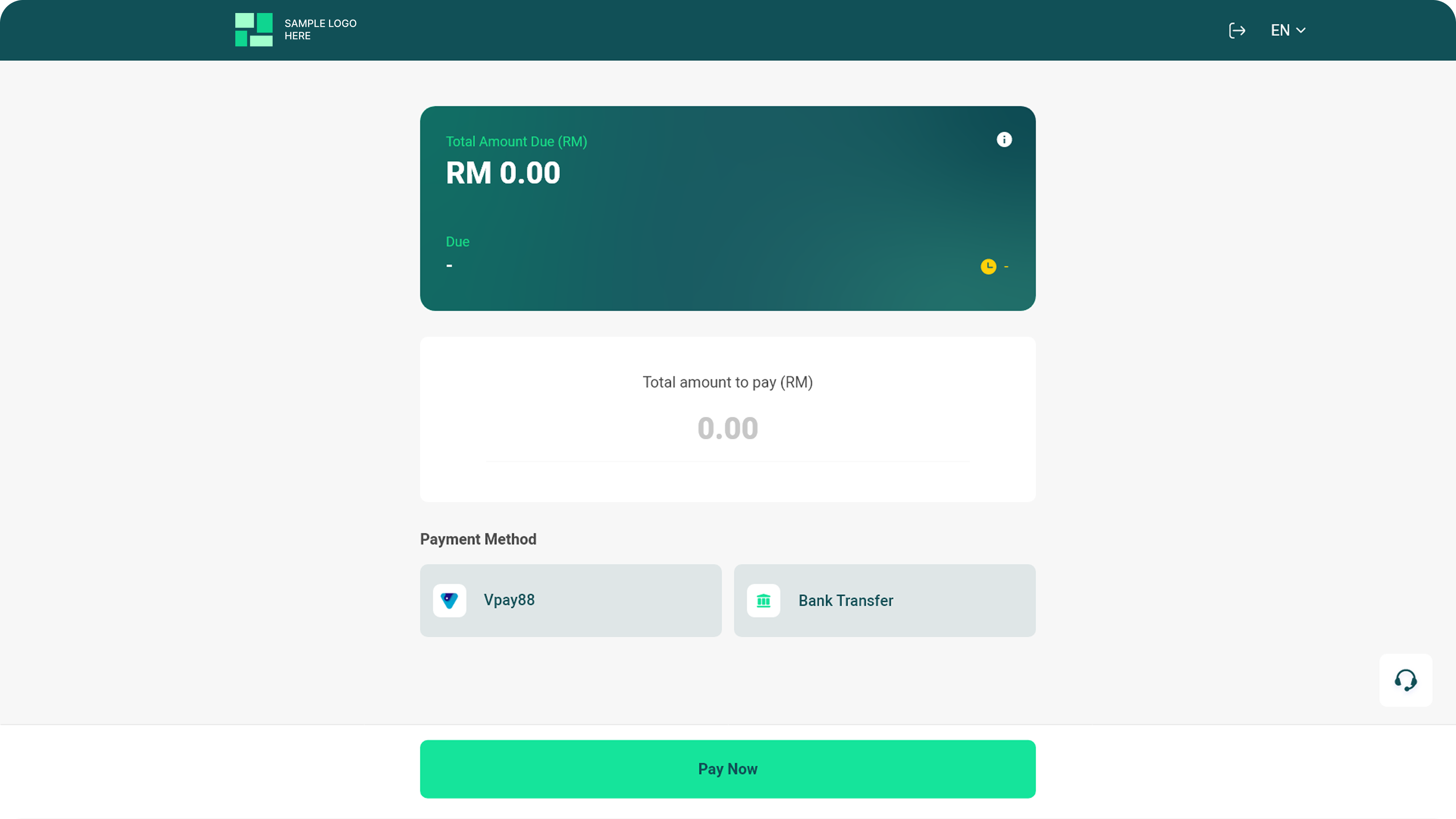

Third-party Disbursement and Payment Gateway

Every automatic disbursement and payment, via cash or online banking, is performed online, allowing your clients to make transfers at their convenience without their bank account info being exposed!

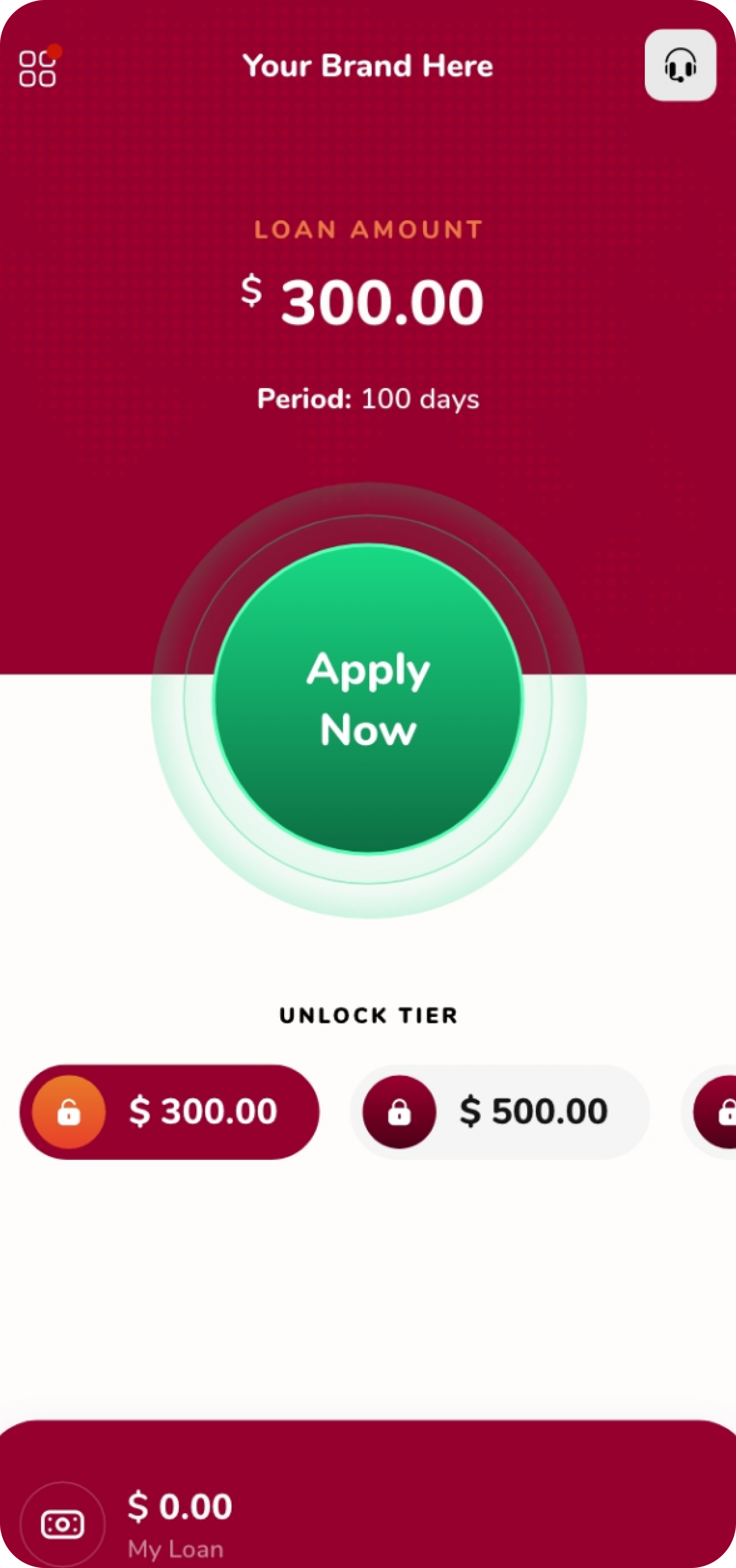

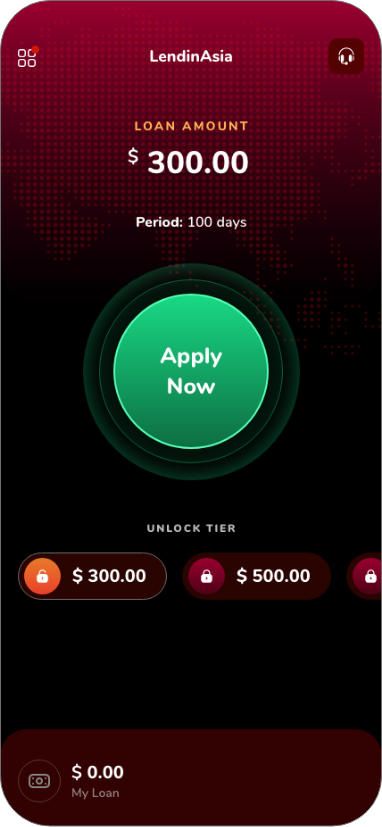

Flexible Loan Packages

We assist you to create short and long-term loans as well as offer multitiered loan packages with unlockable stages.

Even More Robust FEATURES

The Way Your Lending System Should Be.

![]()

Applicant Data Tracking

![]()

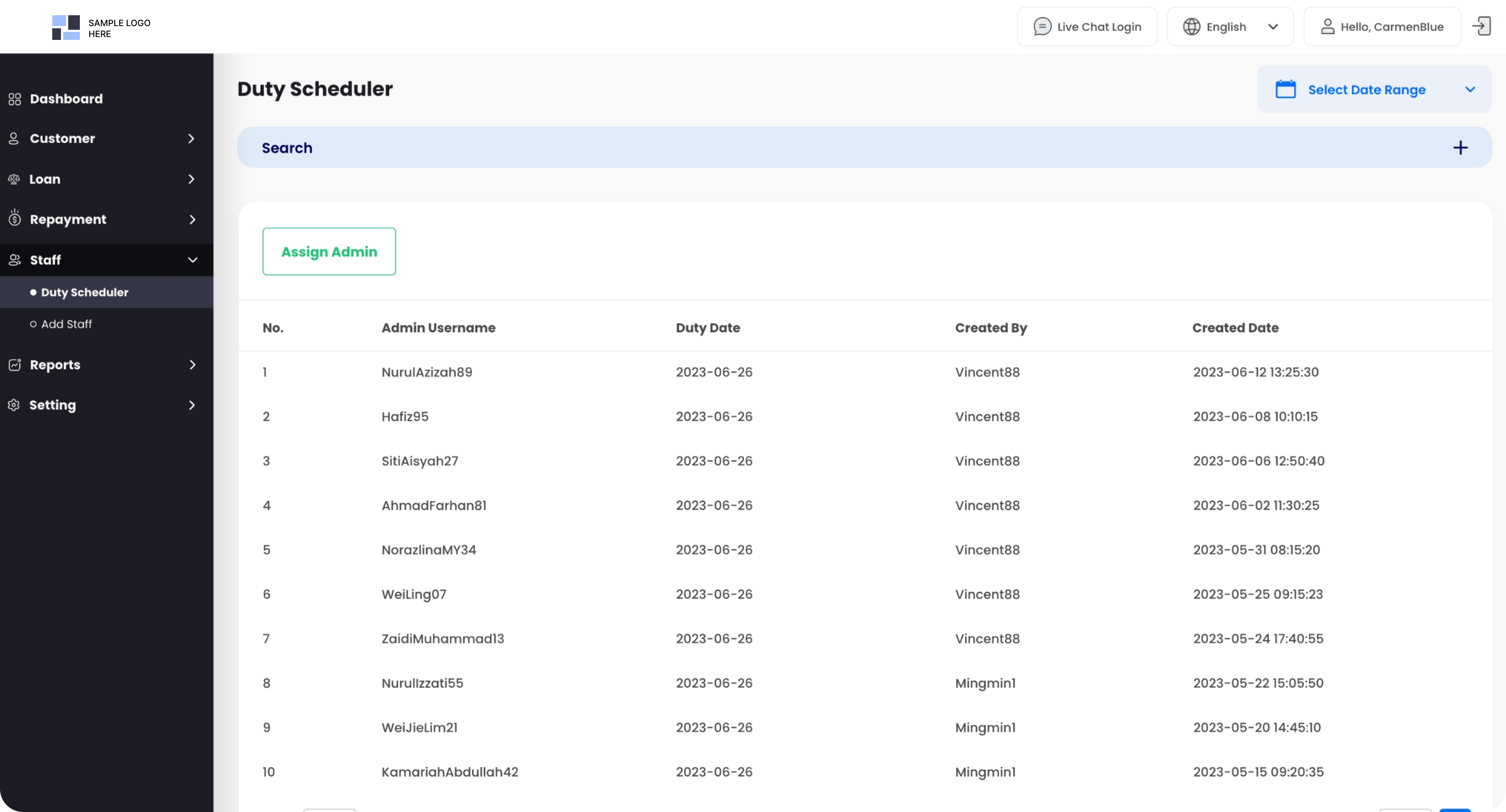

Call Duty Assignment

![]()

User Behaviour Tracking

![]()

Customised Commission Table

![]()

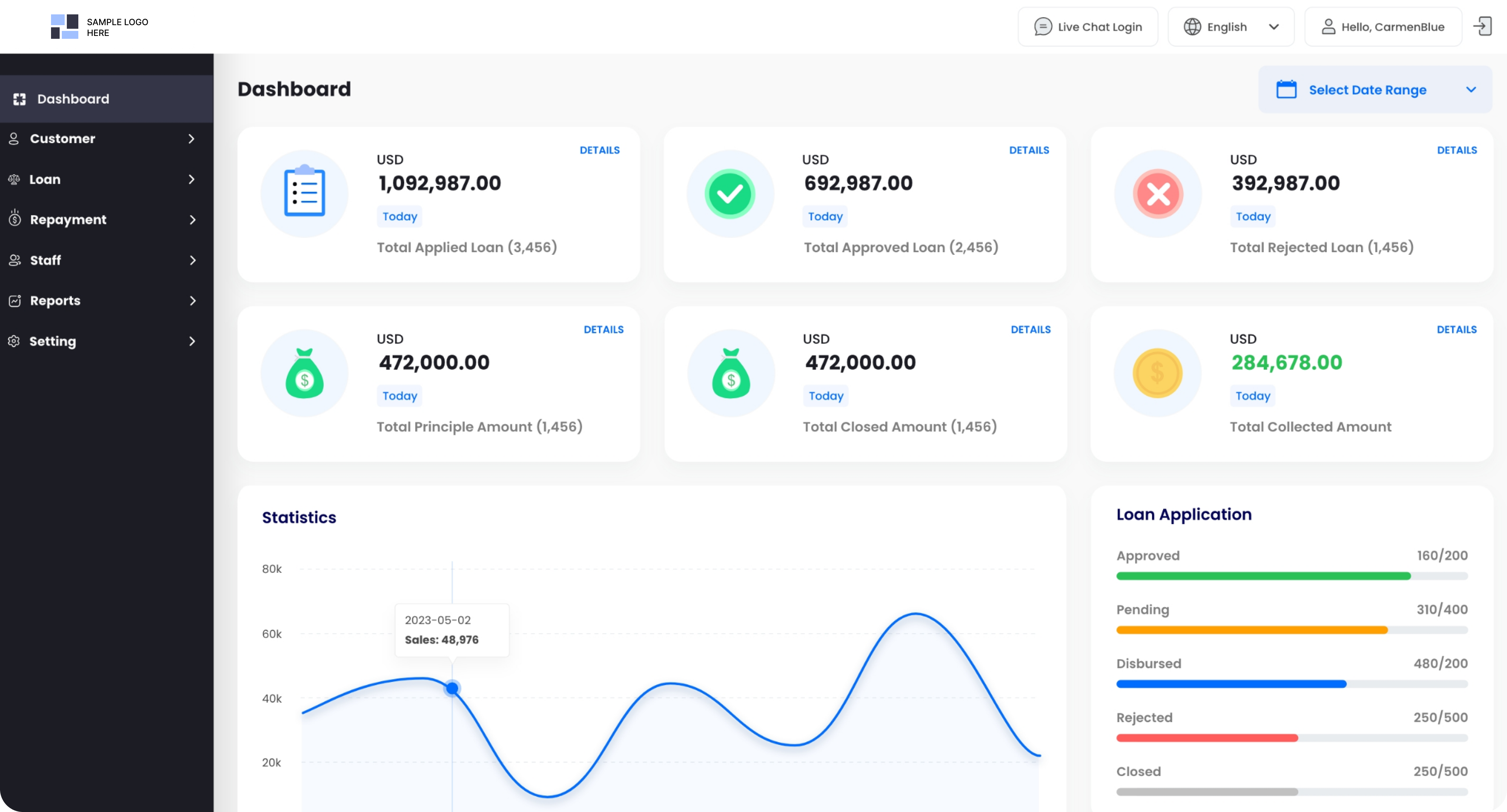

Analytics Dashboard

![]()

Auto or On-Demand Push Notifications

![]()

Stay Signed In

Live Chat

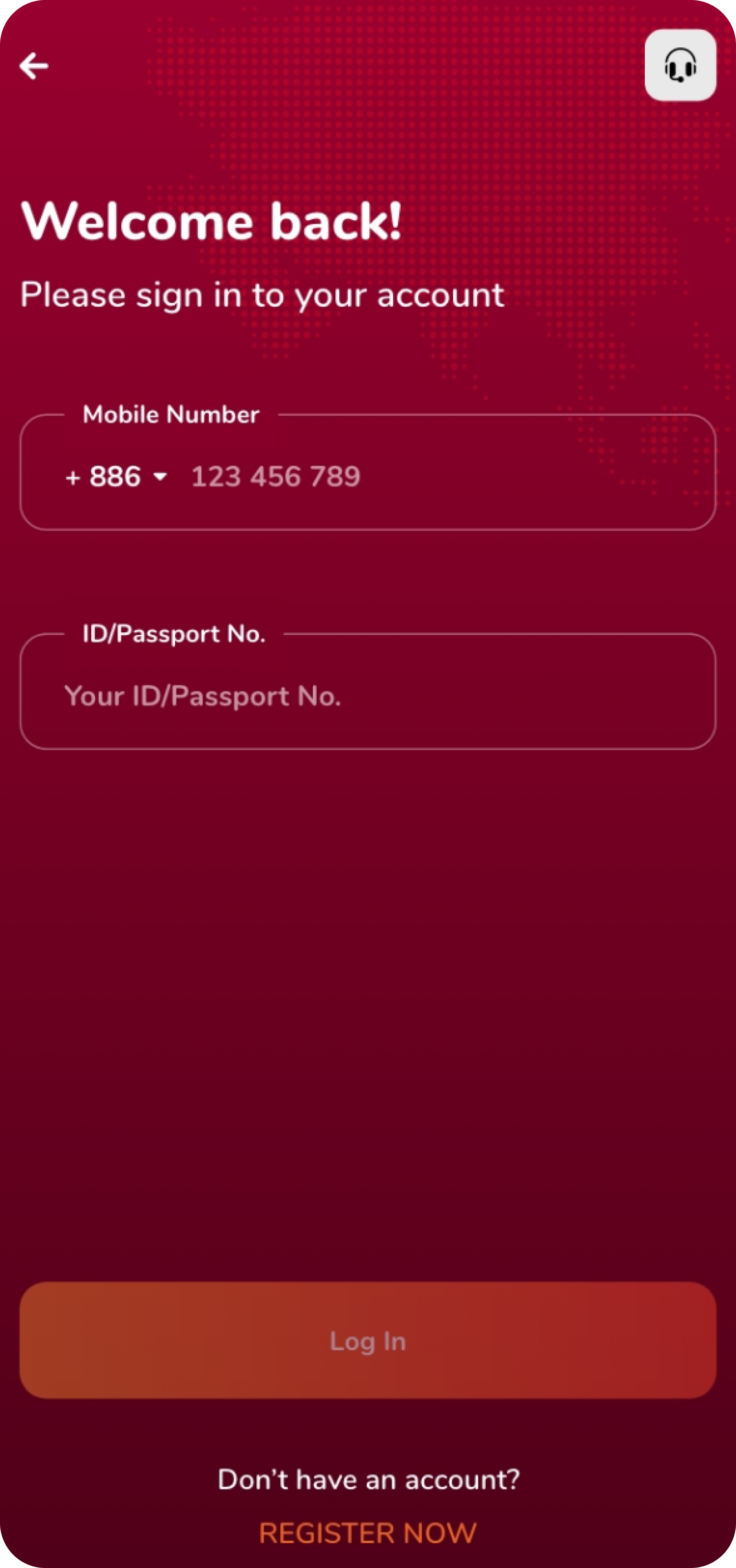

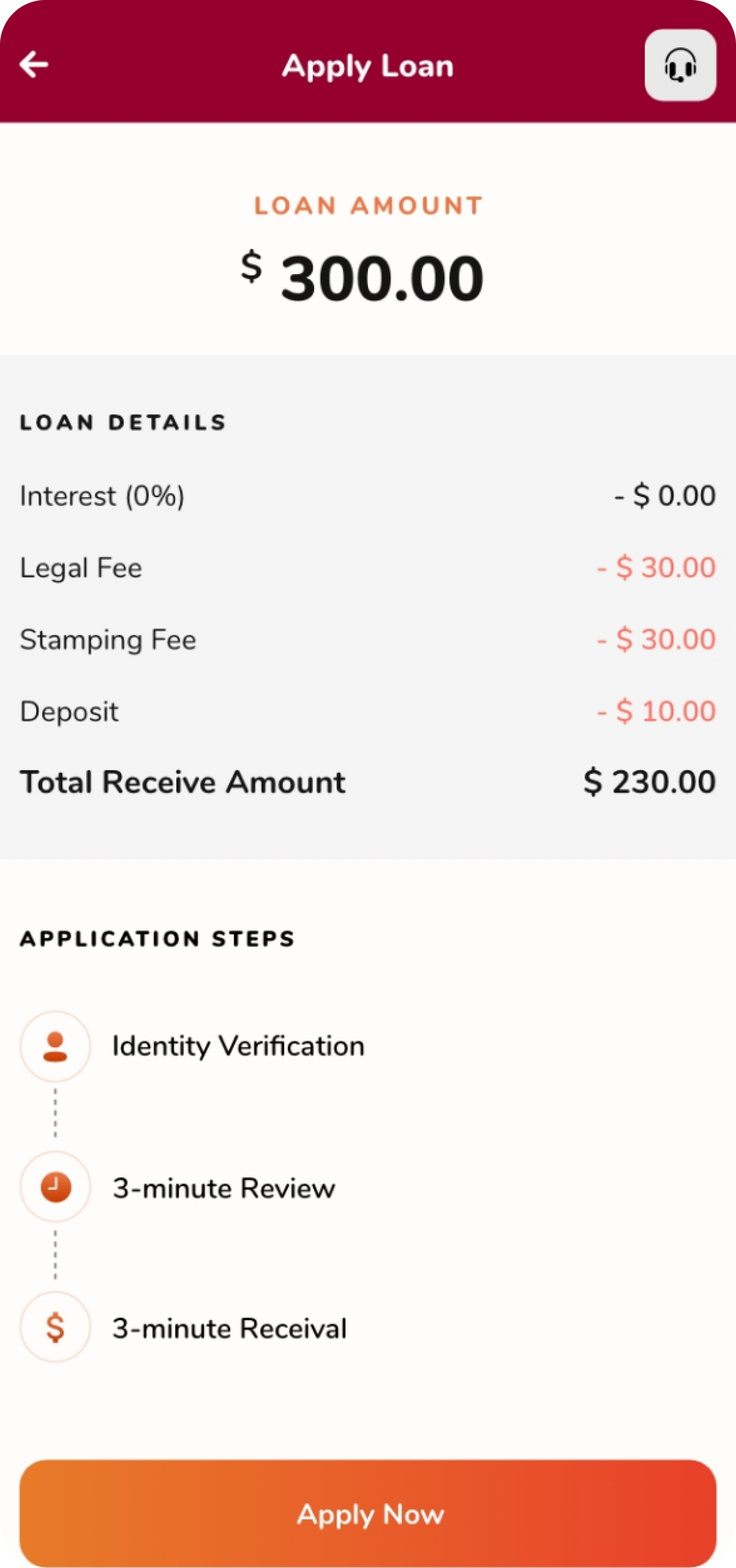

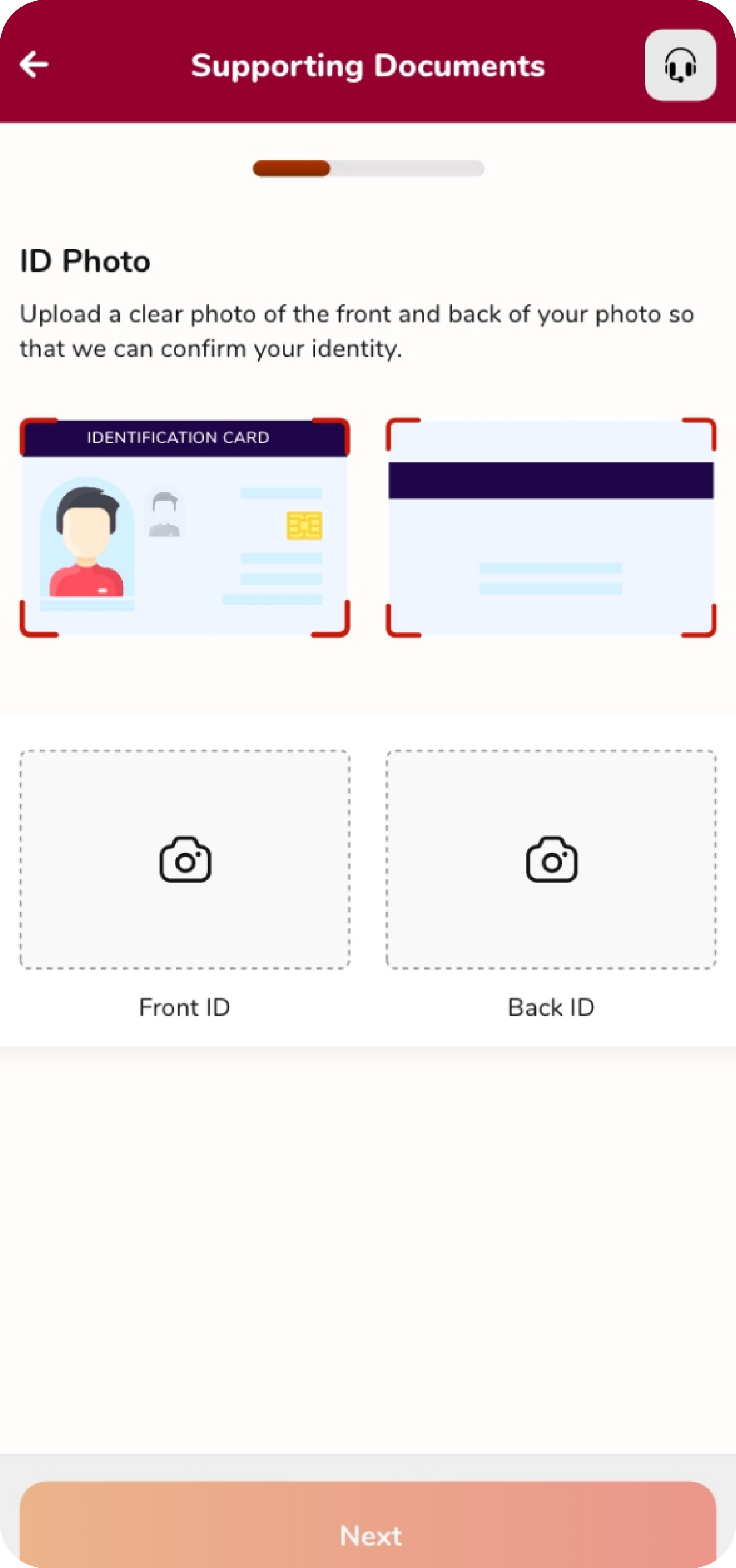

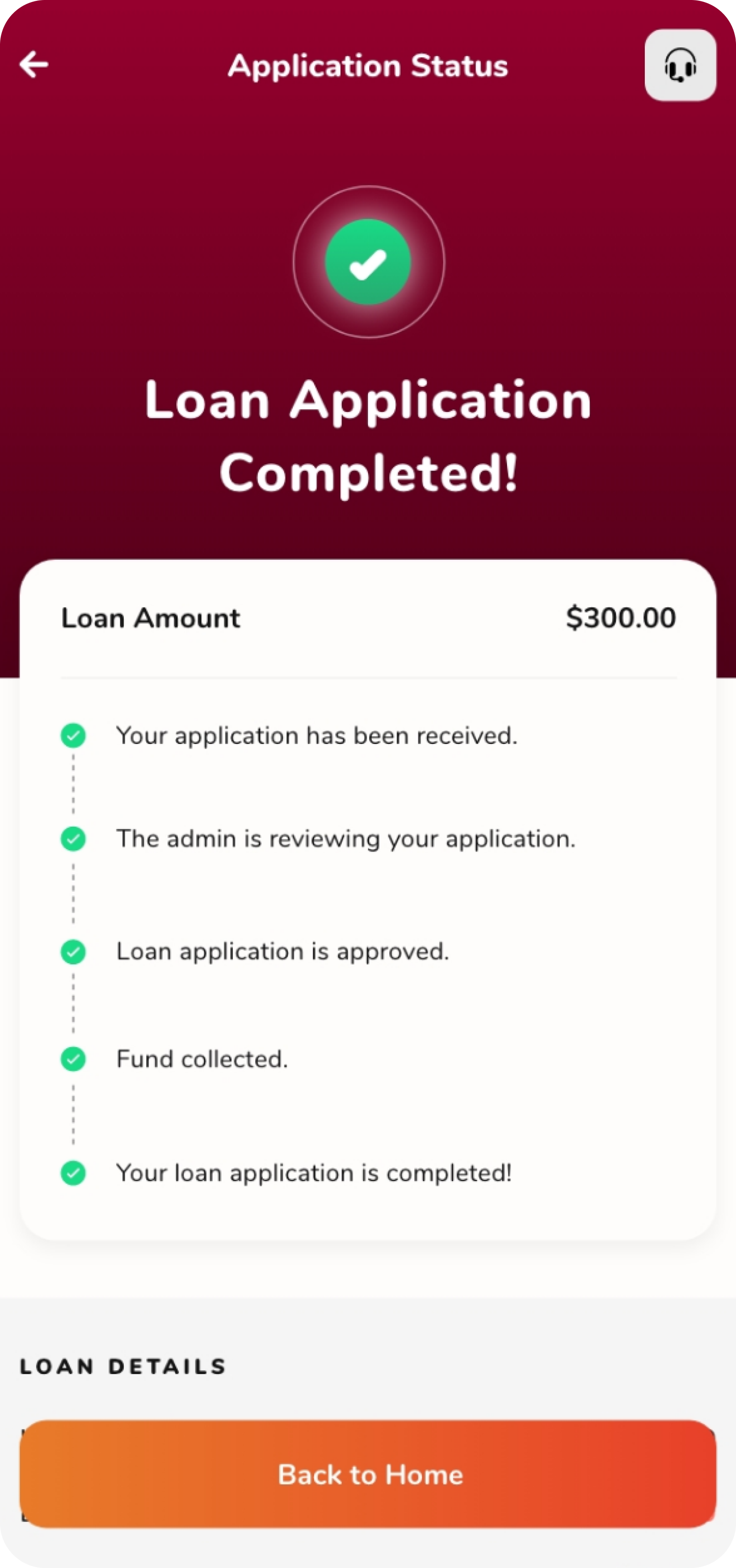

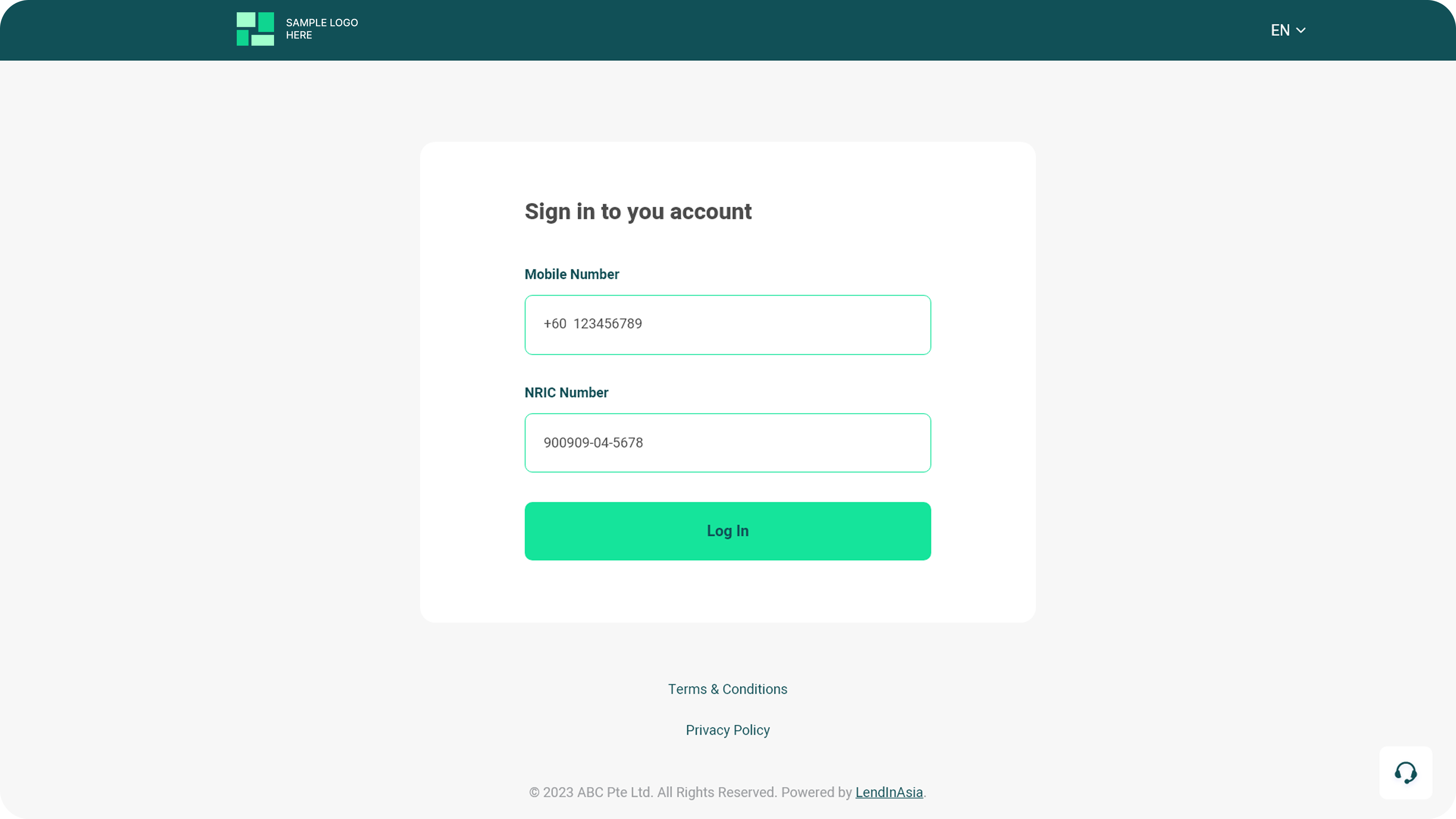

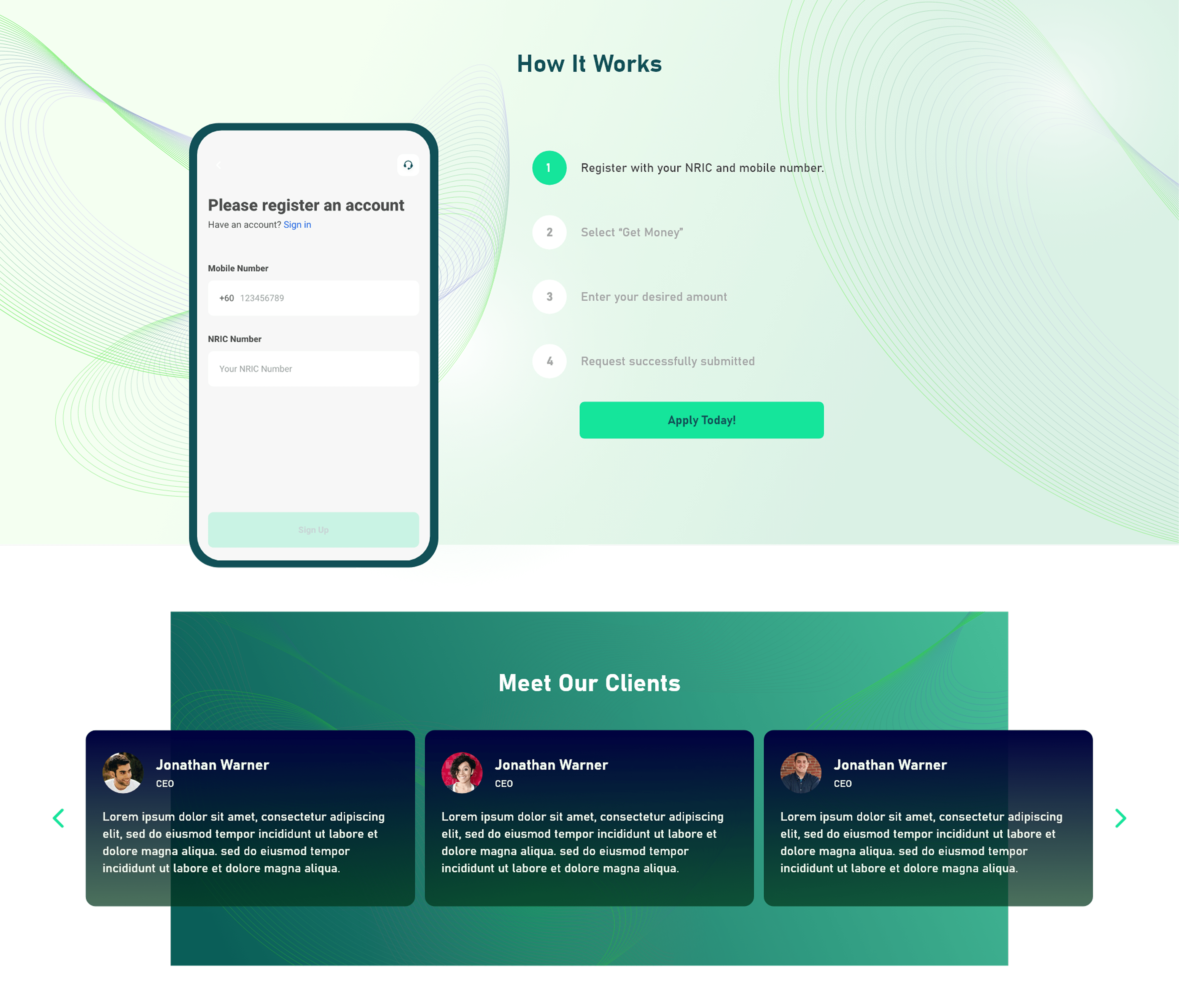

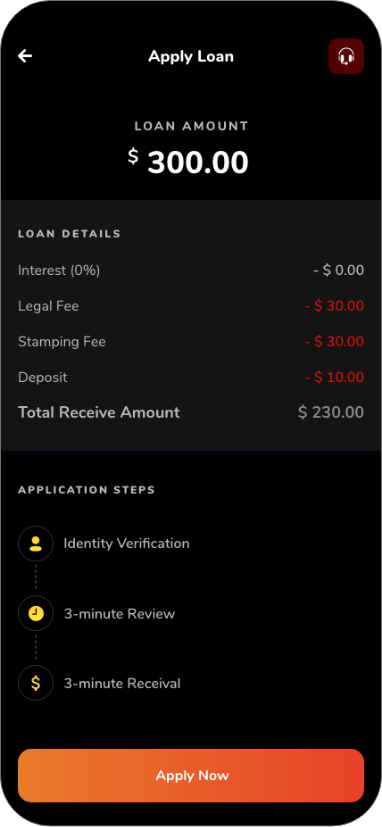

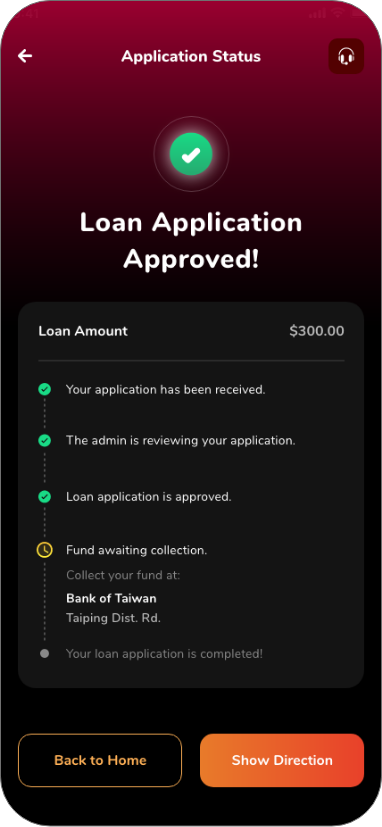

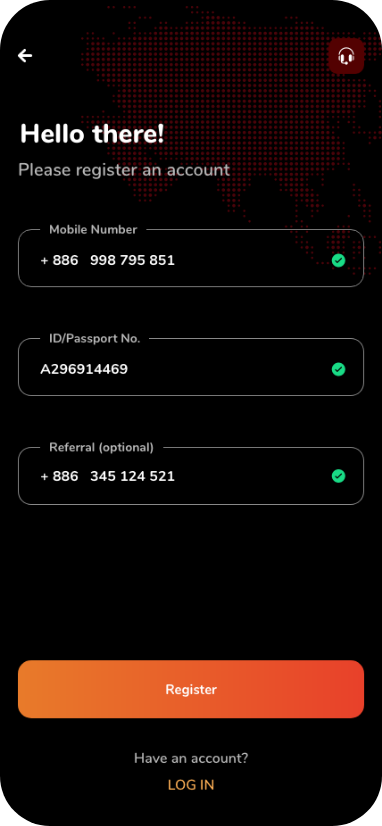

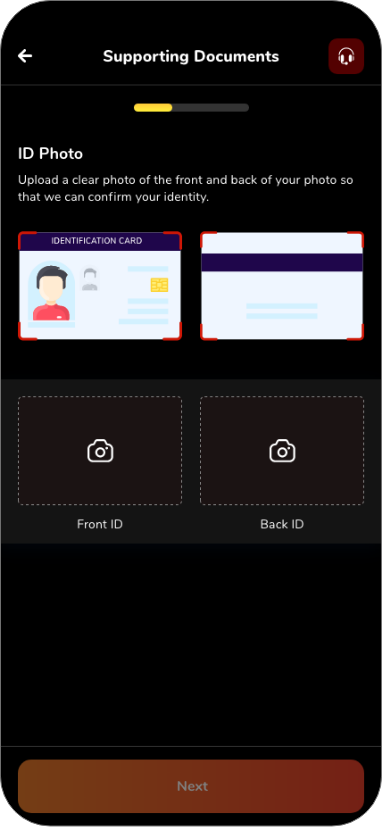

Mobile App Showcase

Built customer retention with a mobile app!

LENDINASIA Your B2B Lending-as-a-Service (LaaS) Leader in the Financial Realm

No confusion, no extra. We make it easier for you.

FROM USD11,900

(One-time Setup Fee)

* No contract, 2 weeks processing time *

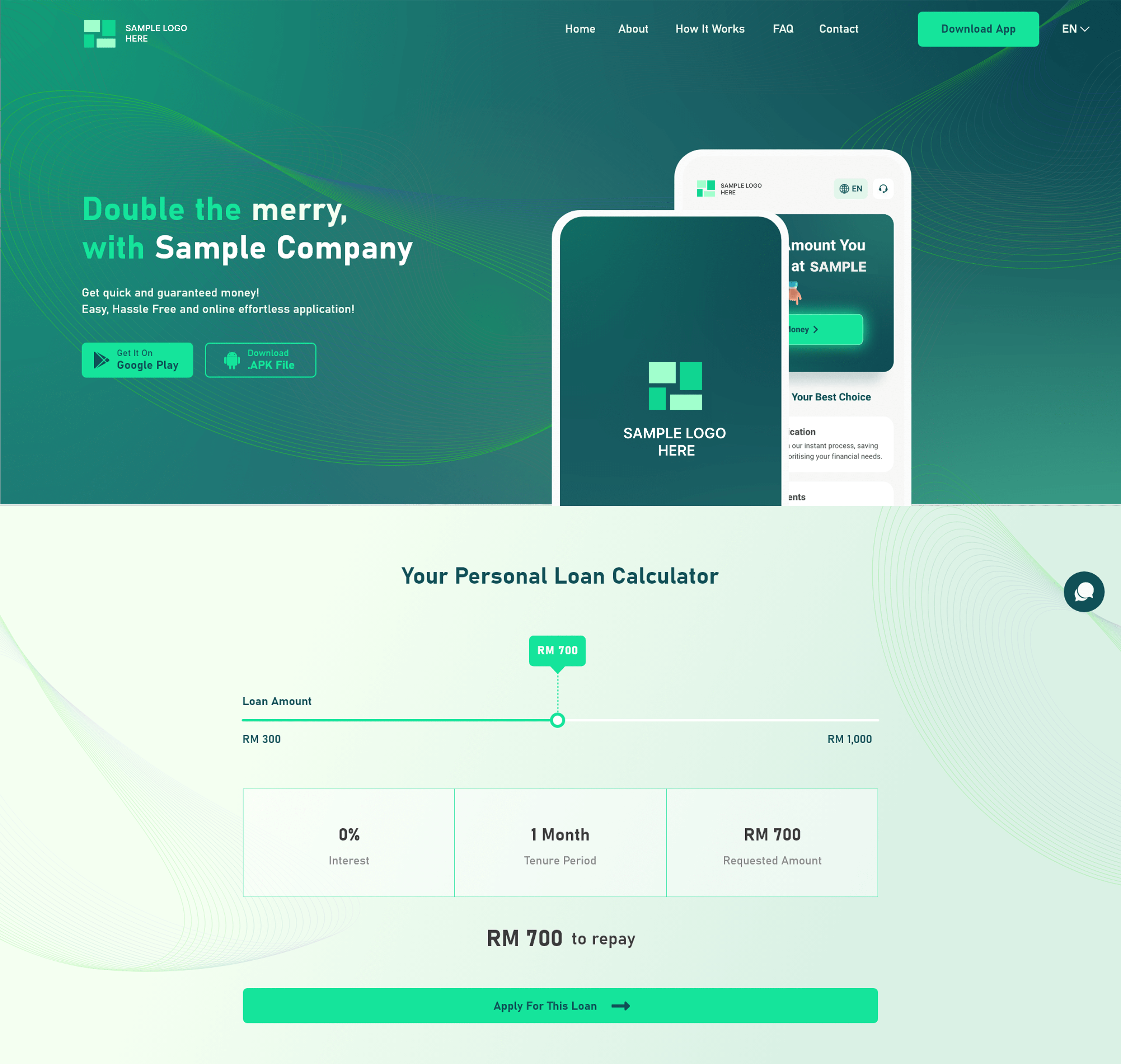

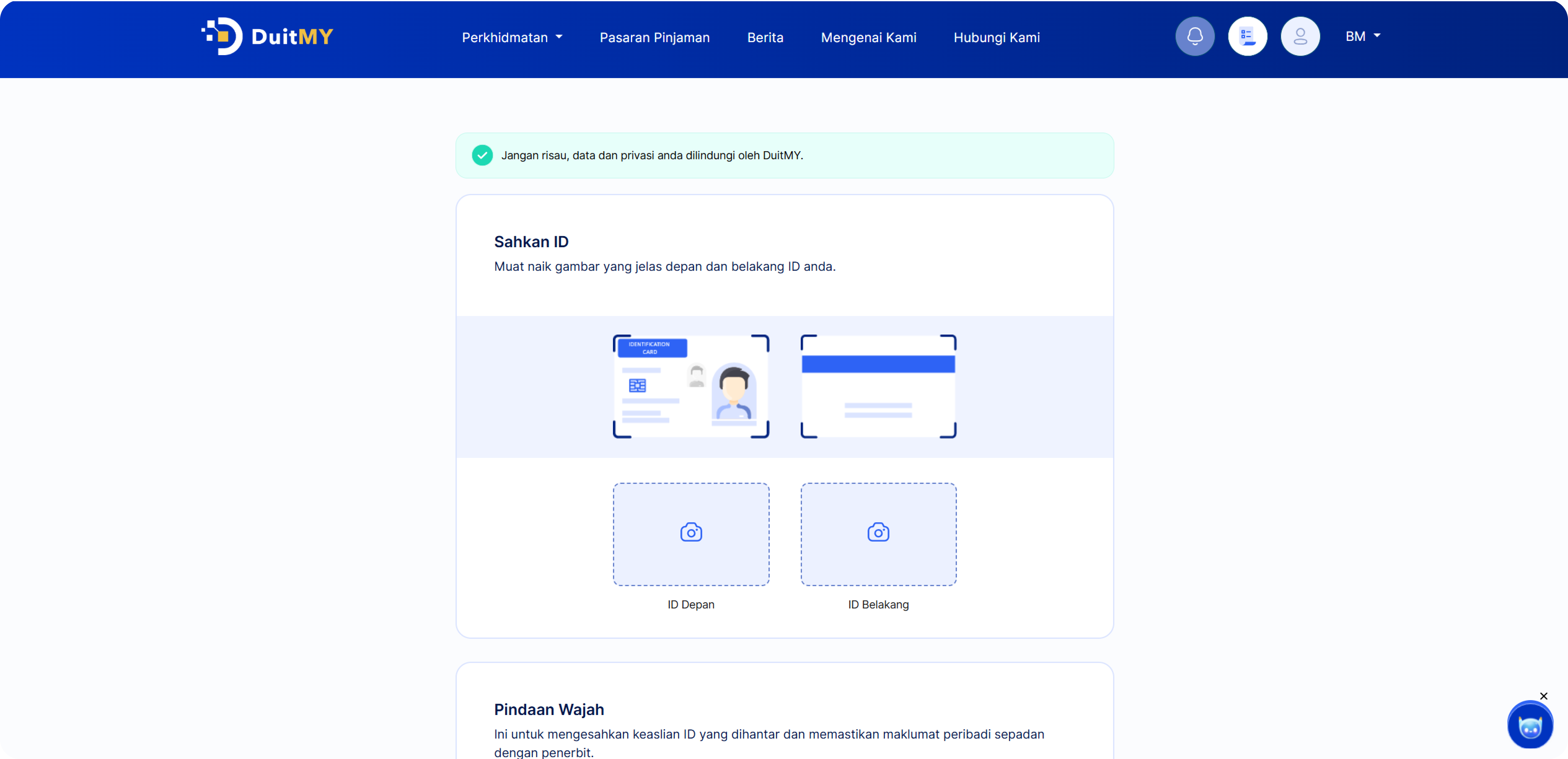

- Landing/Corporate Webpage

- Backend Admin Panel

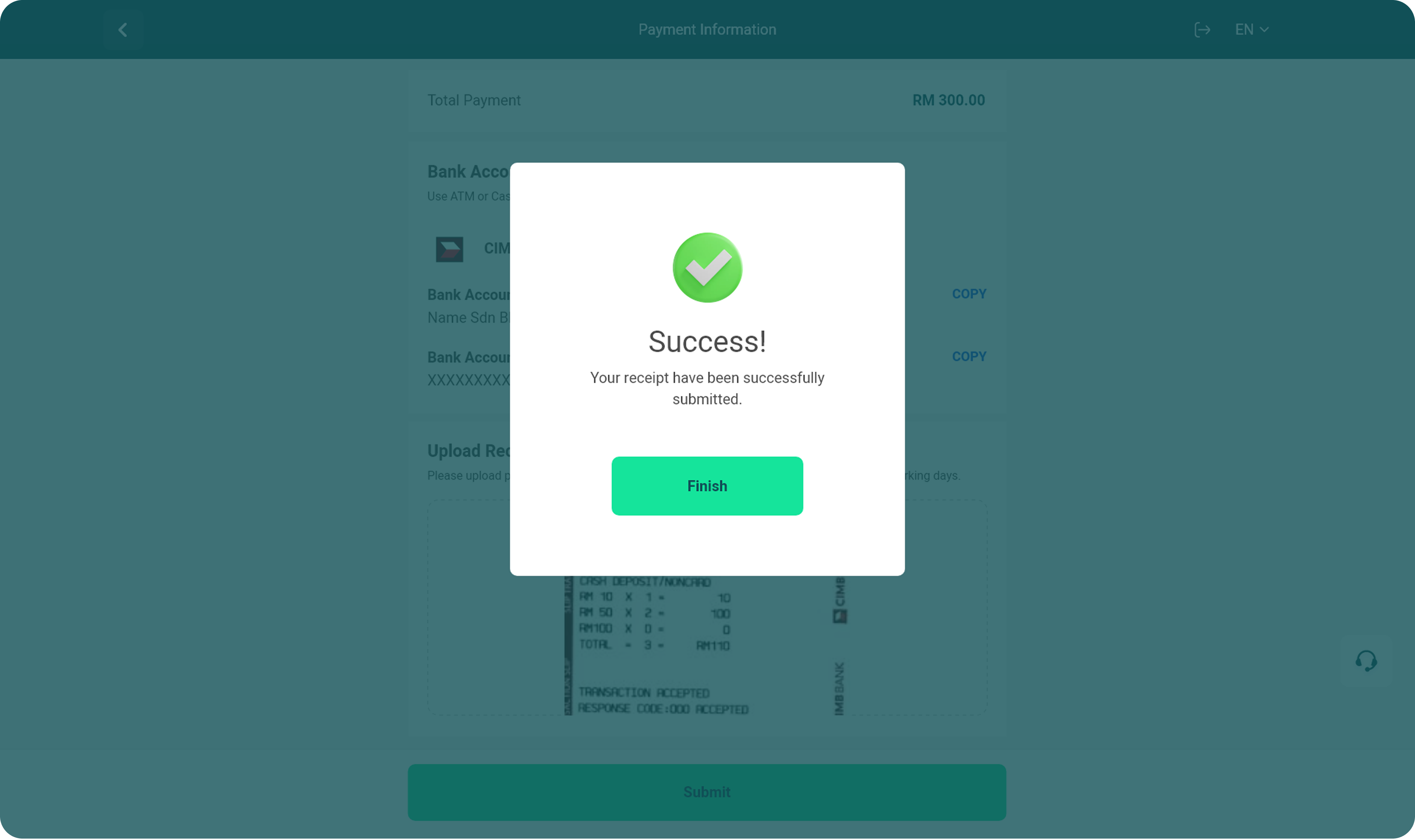

- Repayment Website

- Android & iOS Apps (Customer Version)

- Android & iOS Apps Download Page

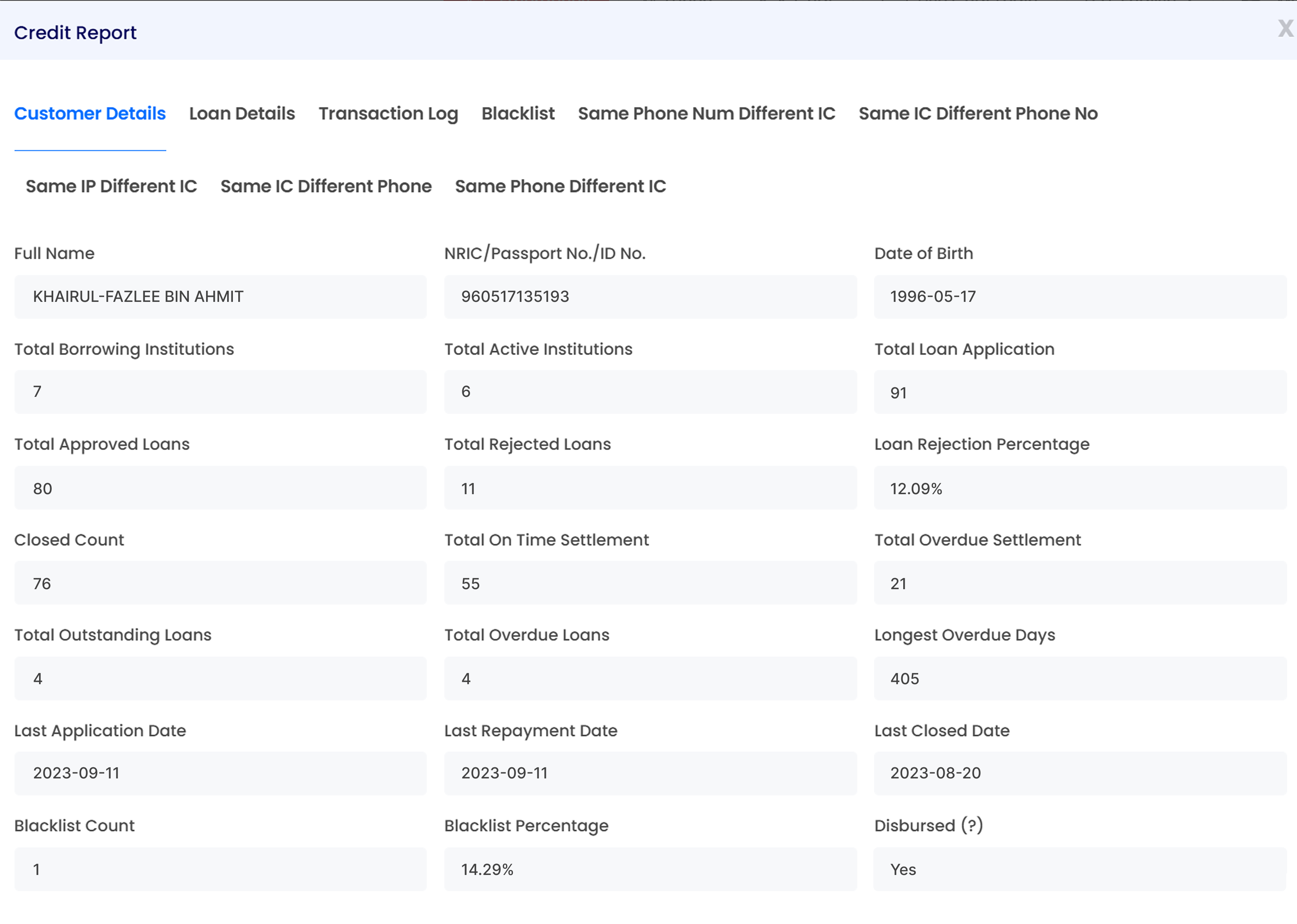

- Credit Report (Basic)

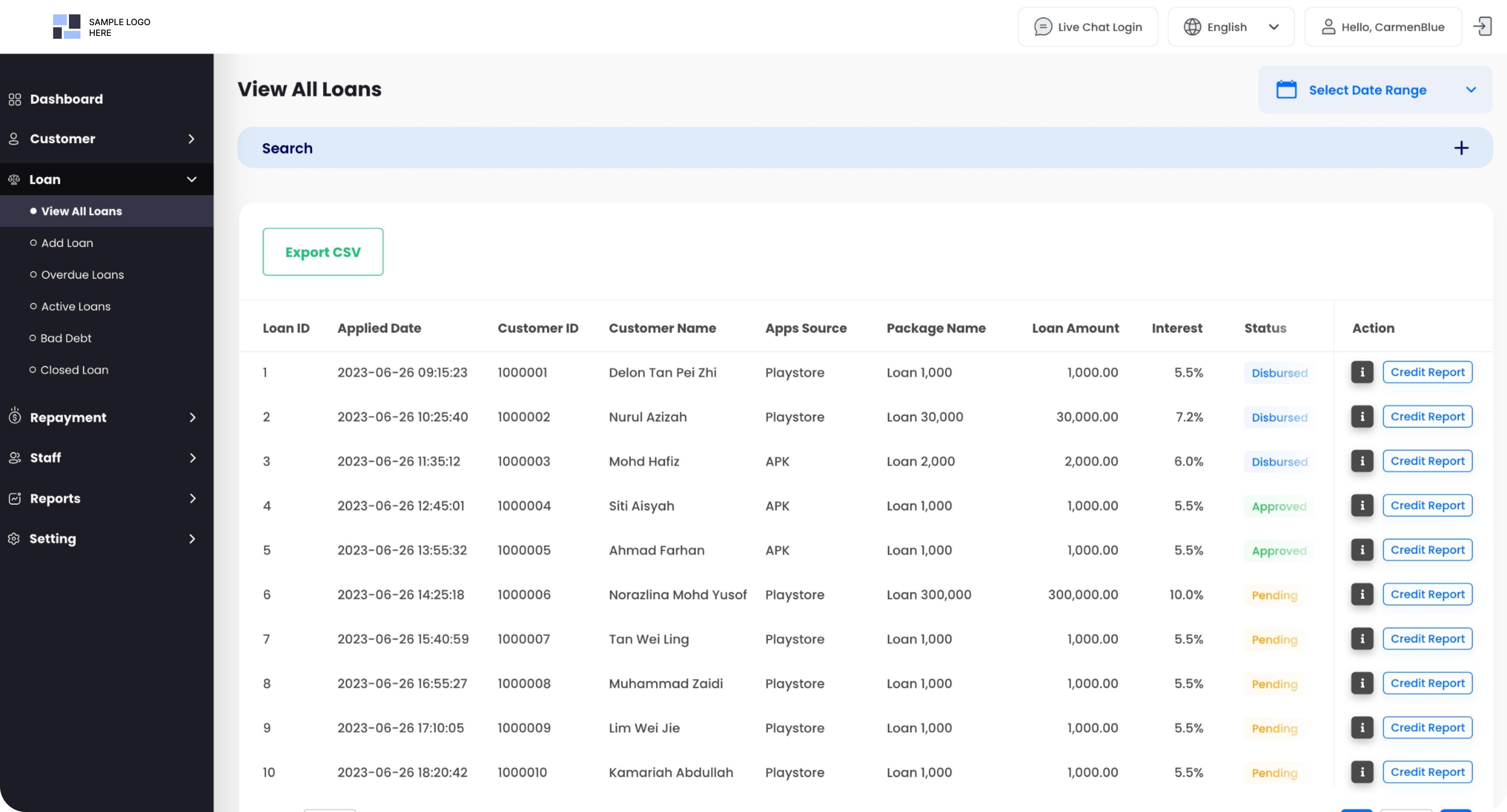

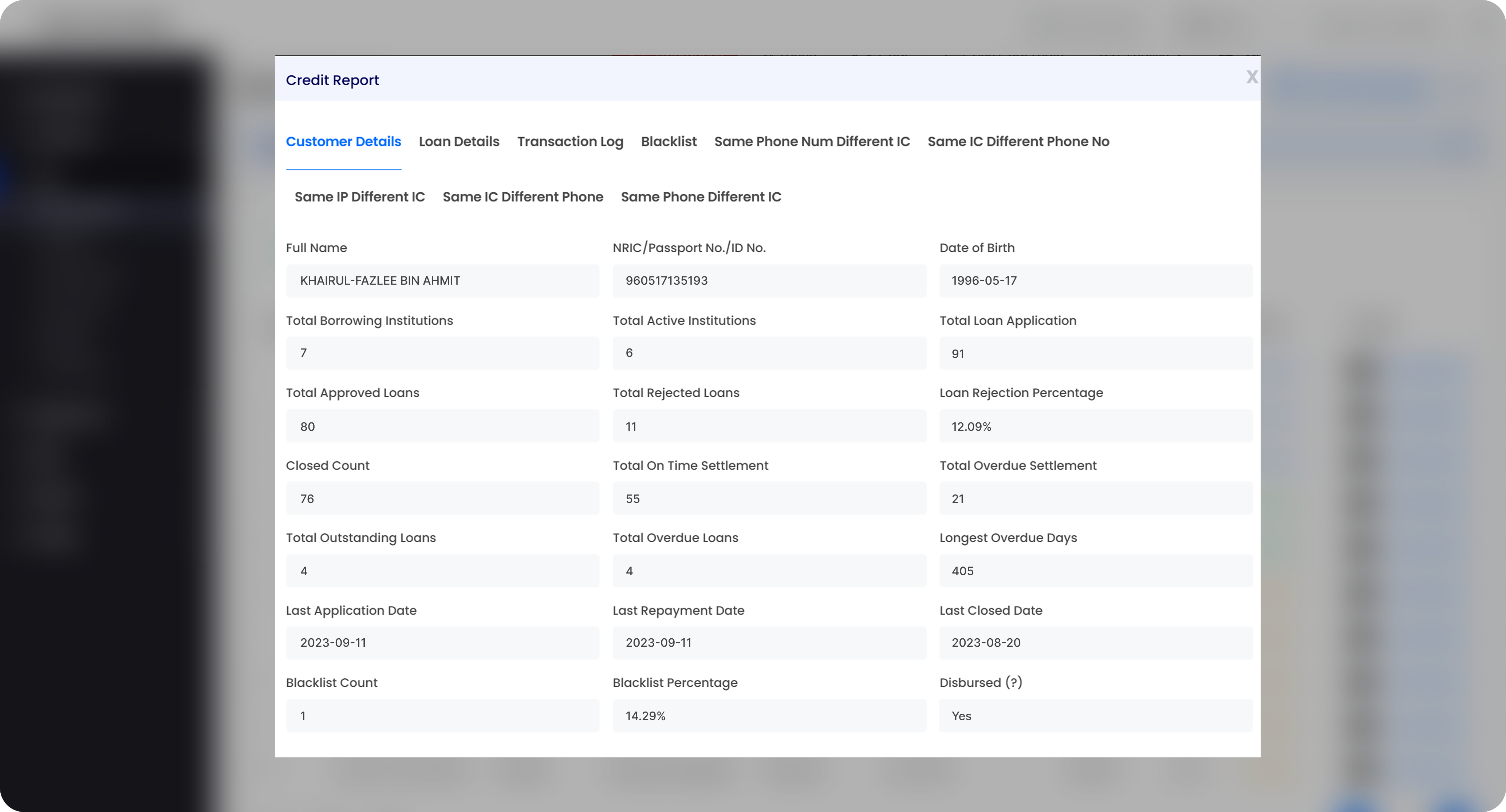

Data pricing from 1.20 USD per unique customer. This comes as free if you subscribe our Loan System™. You are able to check the credit insights such as credit history and financial behavior of all the customers in your system through our extensive credit report database for free.

Data pricing from 1.20 USD per unique customer. This comes as free if you subscribe our Loan System™. You are able to check the credit insights such as credit history and financial behavior of all the customers in your system through our extensive credit report database for free. - Applicant Data Tracking

- Flexible Loan Packages

- Centralised Blacklist Portal

- Enterprise-grade Security

- Multilingual Platform

- Analytics Dashboard

- Push Notifications for Users

- Live Chat

- AWS Cloud Server

- User Behaviour Tracking

- Staff Duty Scheduler

- Customised Commission Table

- Built In Browser-based Calling System via VoIP (Proxy)

- Advanced & Personalised Analysis Reports

- Monthly Maintenance Fee of USD 2,500 or 2% of Total Approved Loan (TAL) --- the higher applies

-

Our Maintenance Covers: -

- Database, Web, App & Domain Server Hosting- System & Server Maintenance- System & Server Upgrades- Responsive & Reliable IT Support Team- A Dedicated Account Manager

FROM USD1.20PER NRIC

(Via Secured API / Ready System)

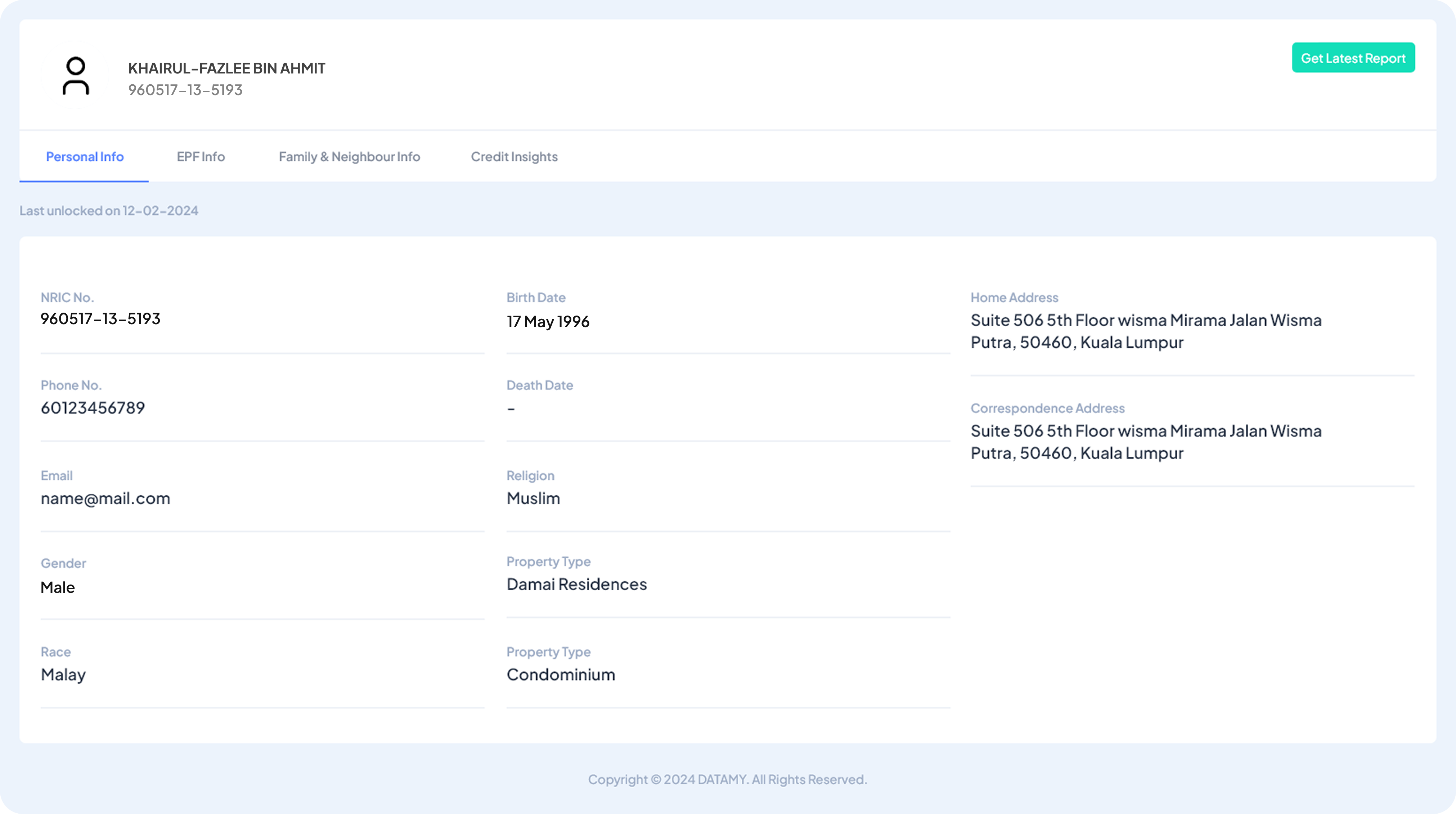

- Customer Details with Credit Data Overview

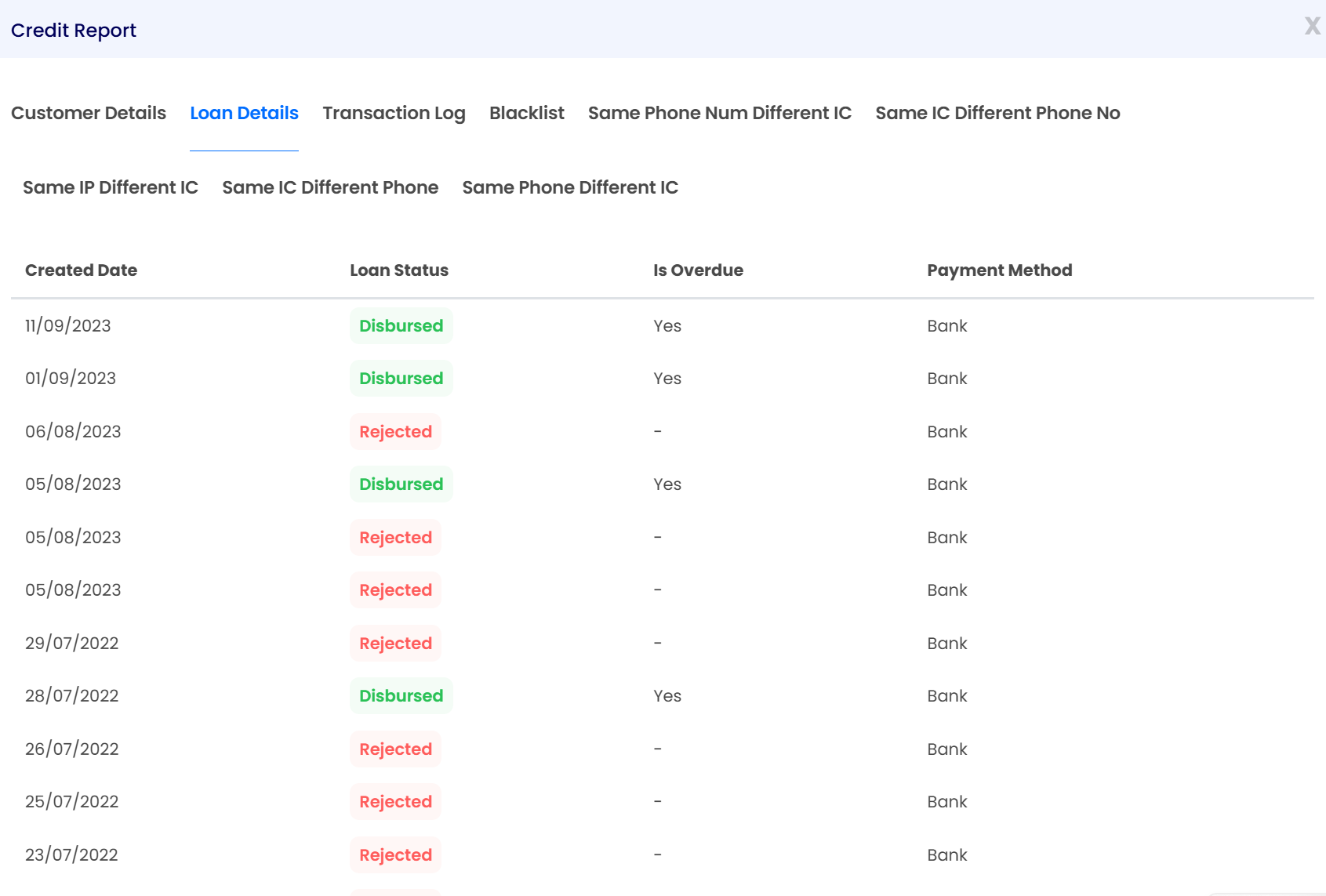

- Loan Details Including Loan Status & Overdue Indicator

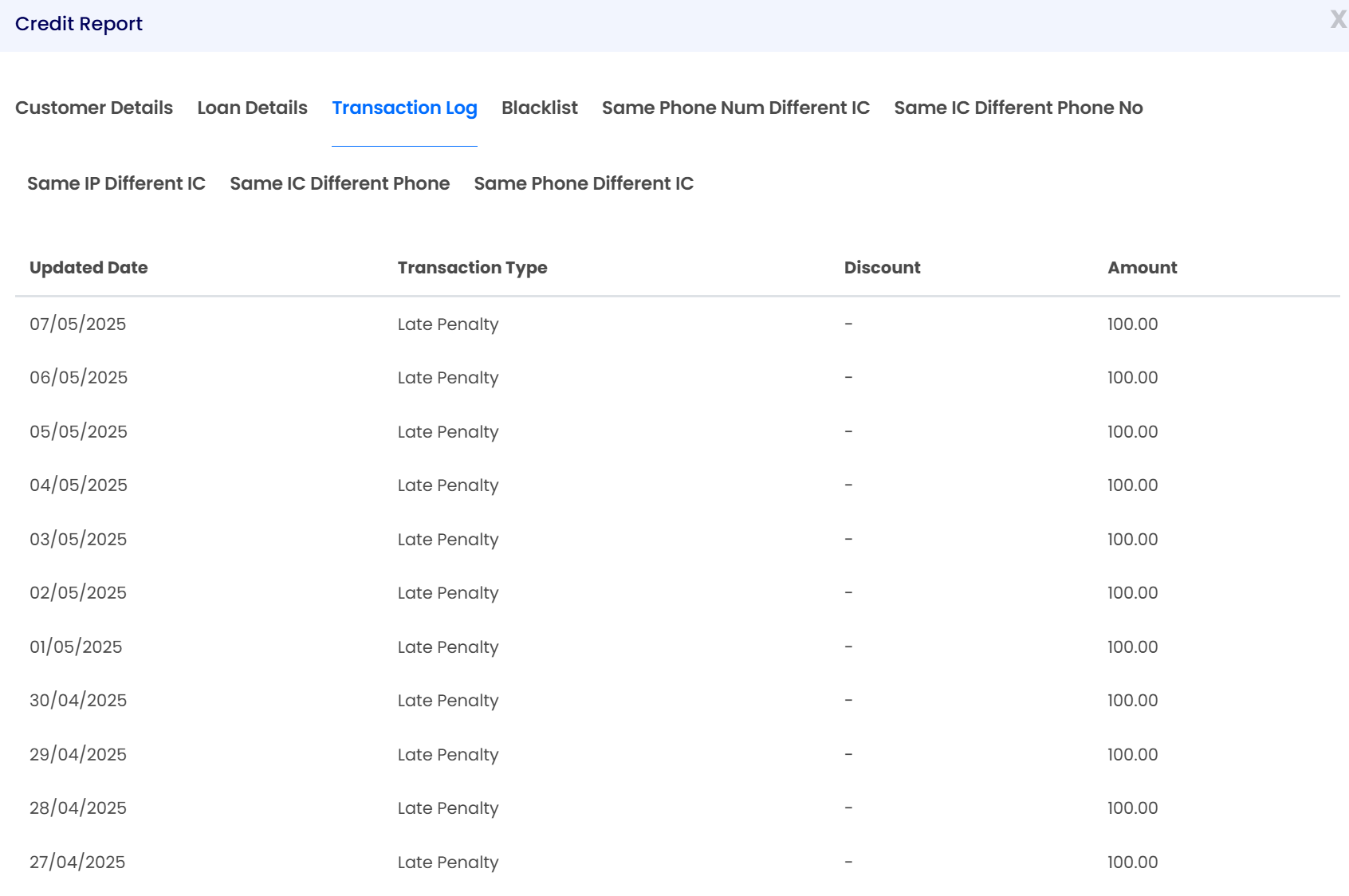

- Transaction Log Detailing Transaction Type & Amount

- Blacklist Information

- Everything in Credit Report (Basic)

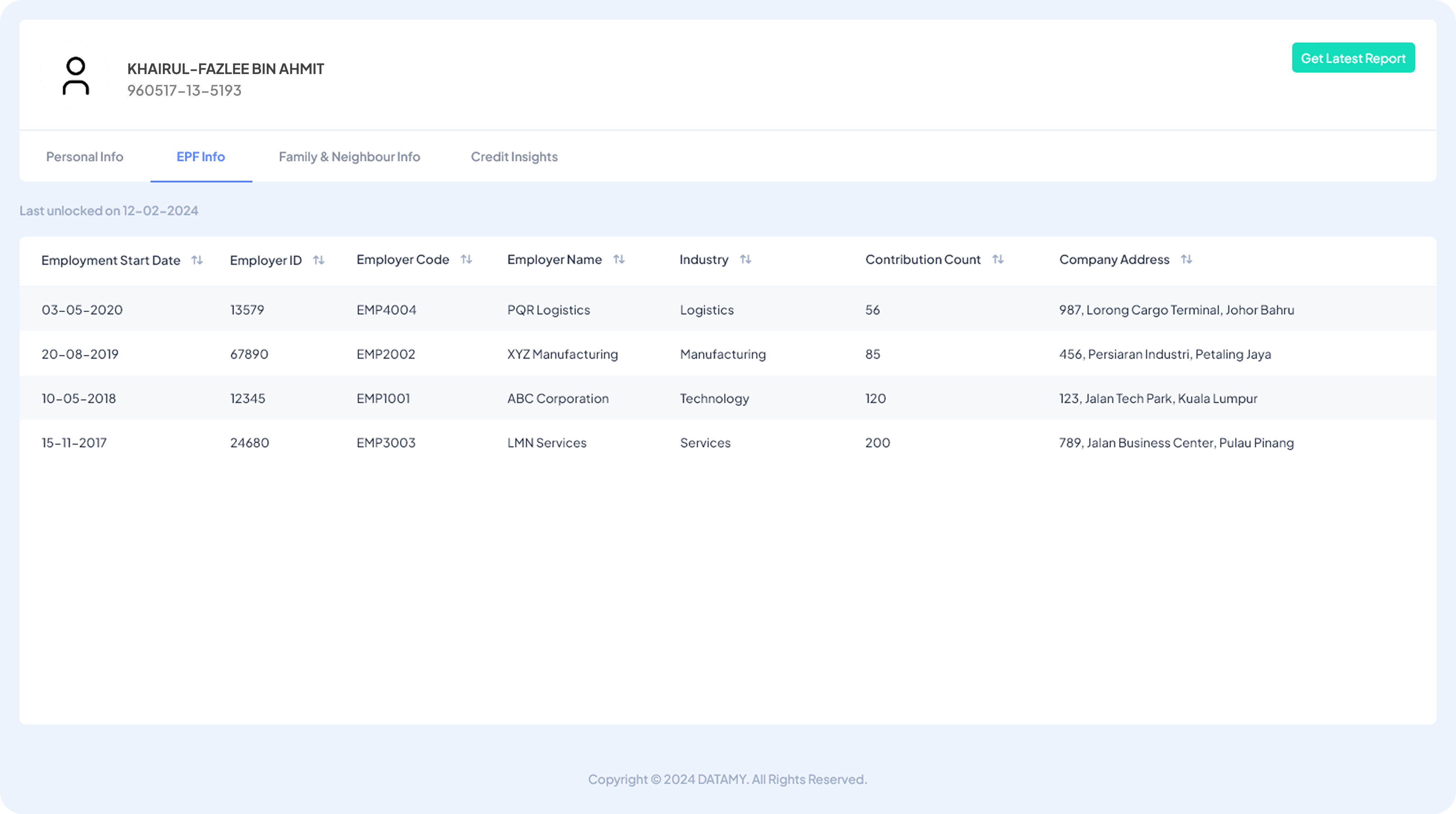

- Personal & EPF Info

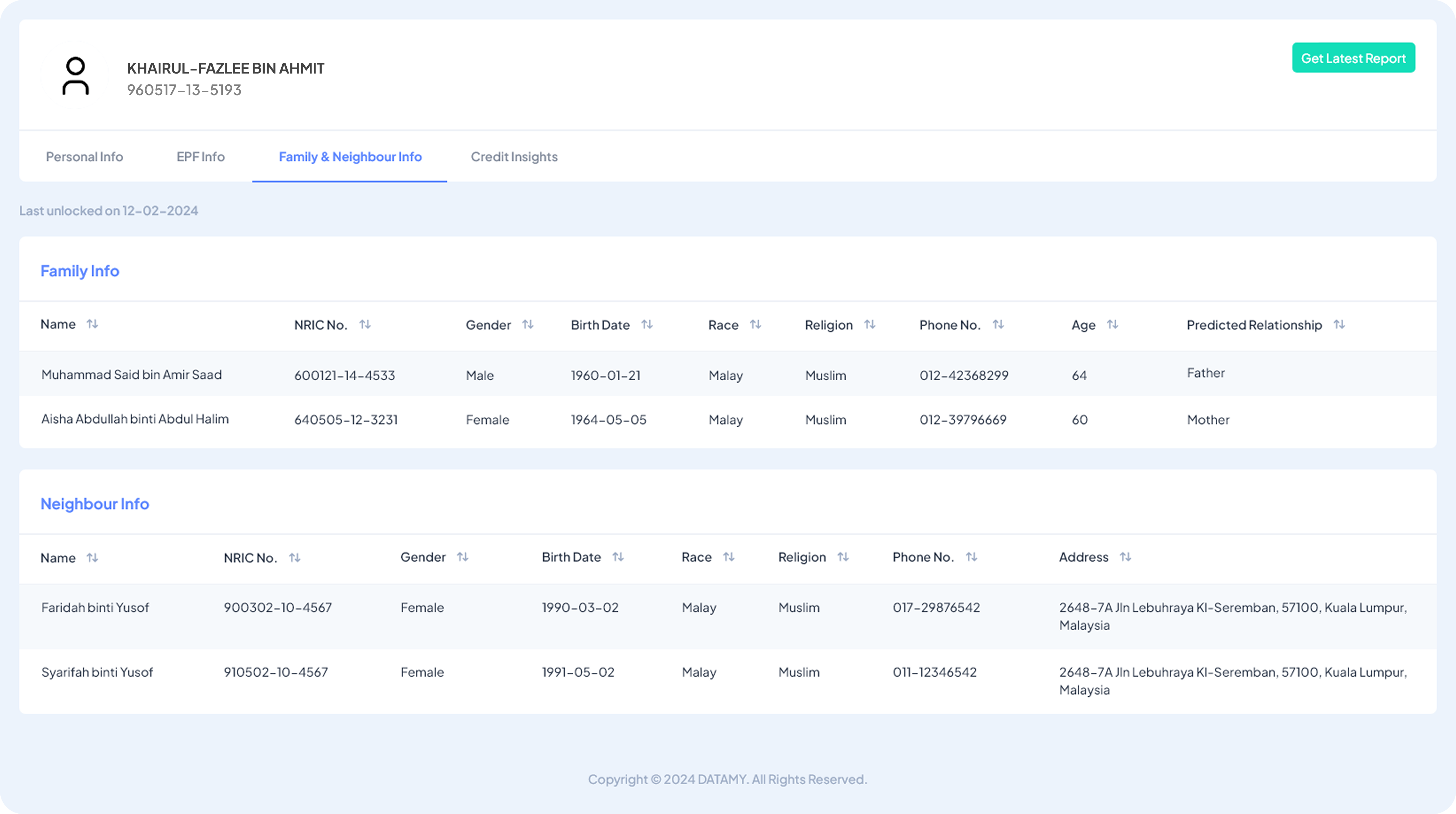

- Family & Neighbour Info

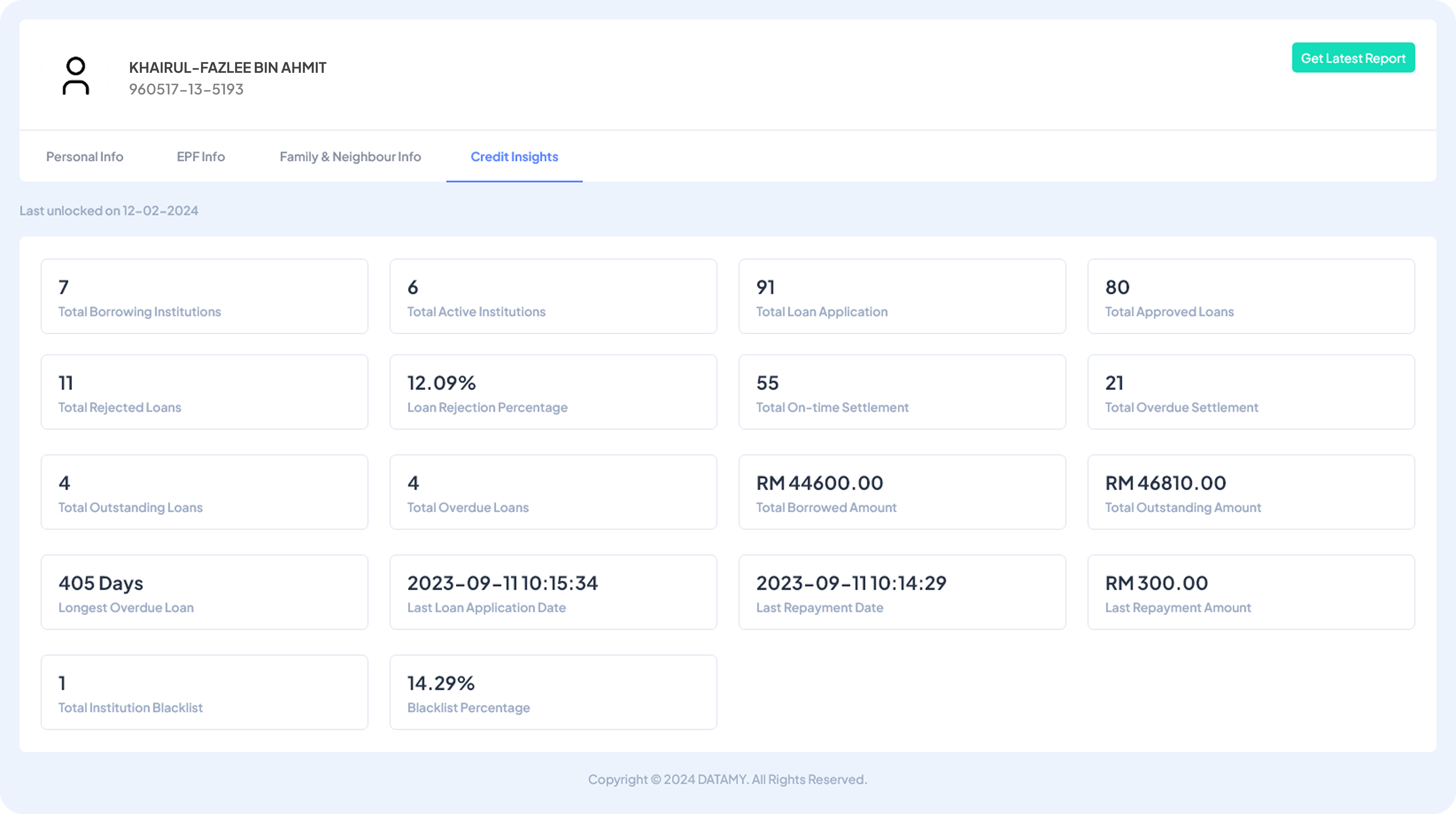

- Advanced Credit Insights

FROM USD750PER MONTH

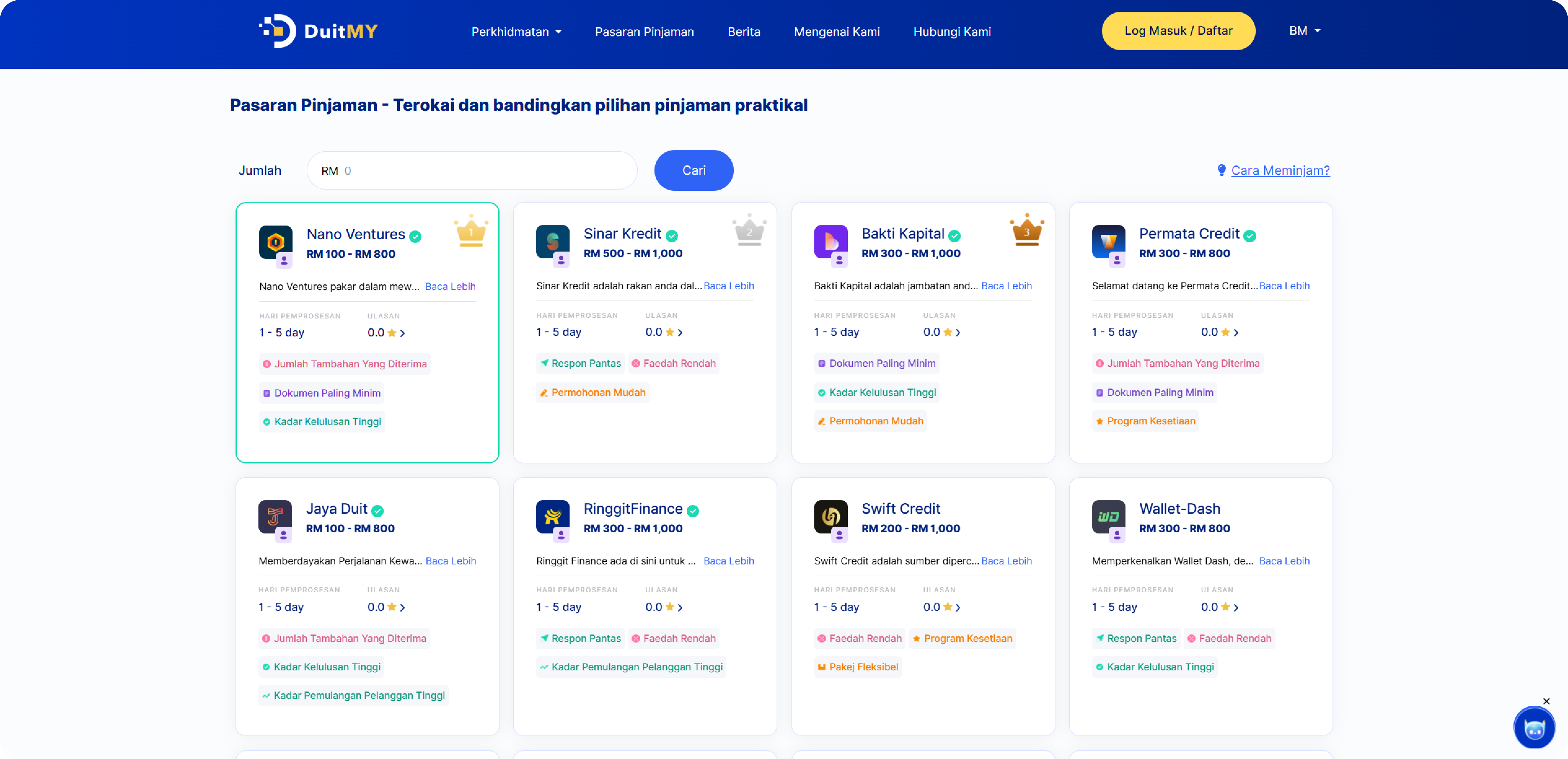

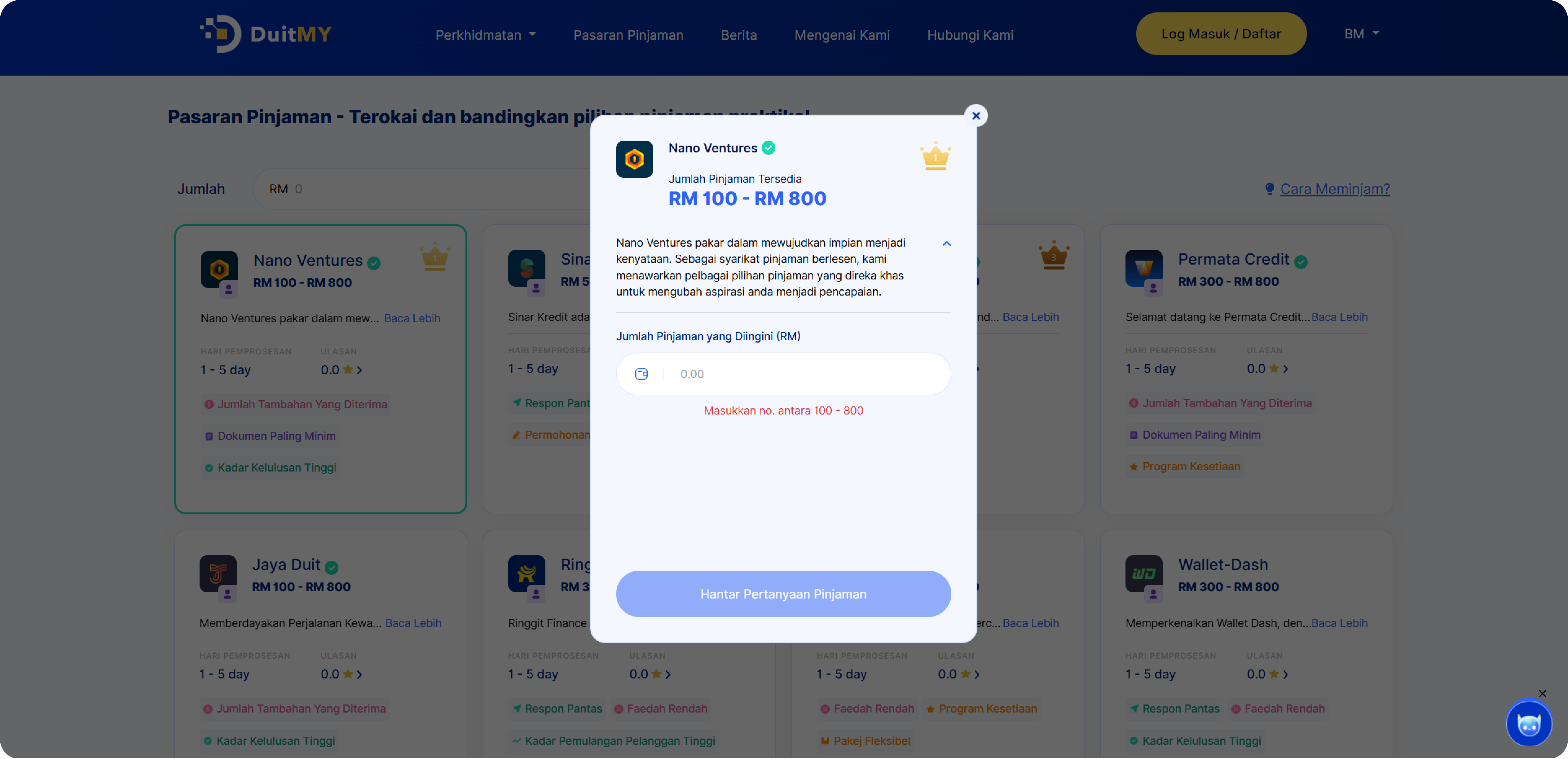

(DuitMY Partnerships)

- Pre-qualified borrower leads tailored to your loan products

- Real-time data and analytics to optimize targeting and performance

- Seamless onboarding and integrations with your existing processes

- Brand visibility in a growing marketplace of active borrowers

FROM USD1.20PER NRIC

(Via Secured API / Ready System)

- Customer Details with Credit Data Overview

- Loan Details Including Loan Status & Overdue Indicator

- Transaction Log Detailing Transaction Type & Amount

- Blacklist Information

- Everything in Credit Report (Basic)

- Personal & EPF Info

- Family & Neighbour Info

- Advanced Credit Insights

FROM USD11,900

(One-time Setup Fee)

* No contract, 2 weeks processing time *

- Landing/Corporate Webpage

- Backend Admin Panel

- Repayment Website

- Android & iOS Apps (Customer Version)

- Android & iOS Apps Download Page

- Credit Report (Basic)

Data pricing from 1.20 USD per unique customer. This comes as free if you subscribe our Loan System™. You are able to check the credit insights such as credit history and financial behavior of all the customers in your system through our extensive credit report database for free.

Data pricing from 1.20 USD per unique customer. This comes as free if you subscribe our Loan System™. You are able to check the credit insights such as credit history and financial behavior of all the customers in your system through our extensive credit report database for free. - Applicant Data Tracking

- Flexible Loan Packages

- Centralised Blacklist Portal

- Enterprise-grade Security

- Multilingual Platform

- Analytics Dashboard

- Push Notifications for Users

- Live Chat

- AWS Cloud Server

- User Behaviour Tracking

- Staff Duty Scheduler

- Customised Commission Table

- Built In Browser-based Calling System via VoIP (Proxy)

- Advanced & Personalised Analysis Reports

-

Monthly Maintenance Fee of USD 2,500 or 2% of Total Approved Loan (TAL) --- the higher applies

-

Our Maintenance Covers: -

- Database, Web, App & Domain Server Hosting- System & Server Maintenance- System & Server Upgrades- Responsive & Reliable IT Support Team- A Dedicated Account Manager

FROM USD750PER MONTH

(DuitMY Partnerships)

- Pre-qualified borrower leads tailored to your loan products

- Real-time data and analytics to optimize targeting and performance

- Seamless onboarding and integrations with your existing processes

- Brand visibility in a growing marketplace of active borrowers

Check Out on the Latest News

Click here to discover breaking news, packages and more!

Try our full-featured demo now. No credit card required.

There is no better way to witness what LendInAsia is capable of than to actually use it.

Get in Touch

Let us discuss your project and build something awesome together.